One of the top questions our clients ask before investing in a Bali villa is: How much return can I expect?

When talking about how much income your property is generating, we often come across two key real estate terms: rental yield and ROI (return on investment).

While both are essential metrics for property investors, each one is actually quite different.

Rental yield is the percentage of profit earned from renting out a property compared to its purchase price over one year.

Investors use this metric to evaluate the potential returns (ROI) of a property. It’s perfect for understanding the fast cash your investment can generate.

Now, let’s go back to the main question: What is a good Bali villa rental yield today and in 2026?

And of course, the equally important follow-up: How do you achieve it?

That's why we write this guide for you. Keep reading to get your answer!

Key Takeaways

- Bali villas generally offer strong returns, with gross rental yields ranging from 5–15%. While net yields typically sit around 3–4%.

- Rental yield is calculated using annual income and property value, and varies significantly across areas.

- Operating costs, location, management quality, and dynamic pricing are major factors that influence your final rental yield and long-term profitability.

- Maximizing yield requires strategic management: choosing the right location, setting competitive prices, offering strong amenities, and ensuring proper legal documents and professional villa management.

How to Calculate Rental Yield?

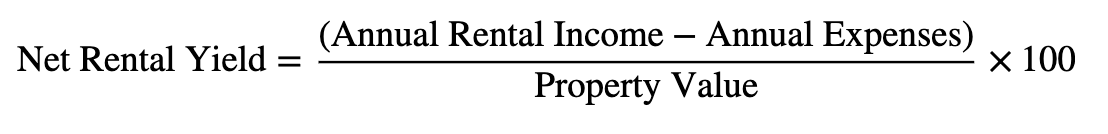

Here’s a simple formula to calculate rental yield:

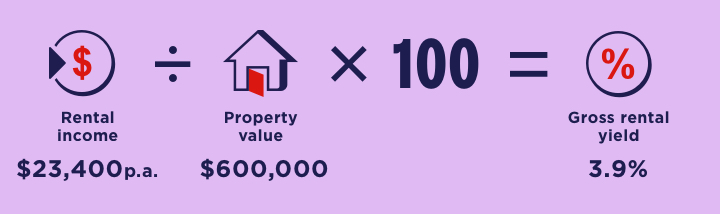

Rental Yield (%) = (Annual Rental Income ÷ Property Value) × 100

Note:

- Annual Rental Income: Add up all the money you expect to earn from renting out your property in a year.

- Property Value: Use the total cost of your property, including property price, taxes, legal fees, or renovation expenses.

For example, you buy a villa in Bali for $300,000. Then, you rent it out per month for $2,000. Your annual rental income would be $24,000 per year.

Your rental yield is: (24,000 ÷ 300,000) × 100 = 8%.

It means your investment villa in Bali gives you an 8% return from rent annually.

That number is already considered excellent for most markets. But in Bali, you might even aim higher with the right investment strategies.

What is a Good Bali Villa Rental Yield?

A gross rental yield of 5% or higher is considered strong in general. While 6%-8% is considered good.

However, the “ideal” percentage will always vary depending on your property’s location and market conditions.

Premium or hotspot areas typically produce higher yields because demand and occupancy rates are more stable.

Case Study Example:

Let’s say you purchase a villa in Berawa for $400,000. This area is a hotspot with occupancy levels reaching 75–85%, and an average nightly rate of $250–$350.

That means your estimated annual income would be around $68,000 to $108,000. Using the rental yield formula, that works out to 17–27% annually (gross yield).

Now, imagine you own a villa in Pecatu priced at $350,000. The area is popular, but not as busy as Berawa, and occupancy sits around 60–70%.

The nightly rate is roughly $150–$220, giving you an estimated annual income of about $32,850 to $56,210. Based on this, the gross rental yield ranges between 9–16%.

Note: Gross yield must be reduced by operational expenses in order to determine the net yield.

Calculating Your "Net" Rental Yield

The figures we’ve been discussing so far are still gross, or the total amount before accounting for operating costs.

Meanwhile, net rental yield shows the percentage of annual rental income remaining after subtracting all operating expenses. This gives a much more accurate picture of your actual profit.

A good net yield is usually around 3–4%. Here’s the formula:

Net Bali Villa Rental Yield Calculation Example

Let's say you have a property in Canggu with this detail:

- Monthly Rent: $2,000

- Annual Rental Income: $2,000 × 12 = $24,000

- Annual Expenses: $5,000 (for maintenance, villa insurance, etc.)

- Property Value (Purchase Price): $300,000

This gives you a net rental yield of:

Net rental yield = [(Annual rental income - annual expenses) / total property value] x 100

= [($24,000 – $5,000) / $300,000] x 100

= 0.0633 x 100

= 6.3%Read More: How to Set Up Villa Price on Airbnb for More Guests and Profits

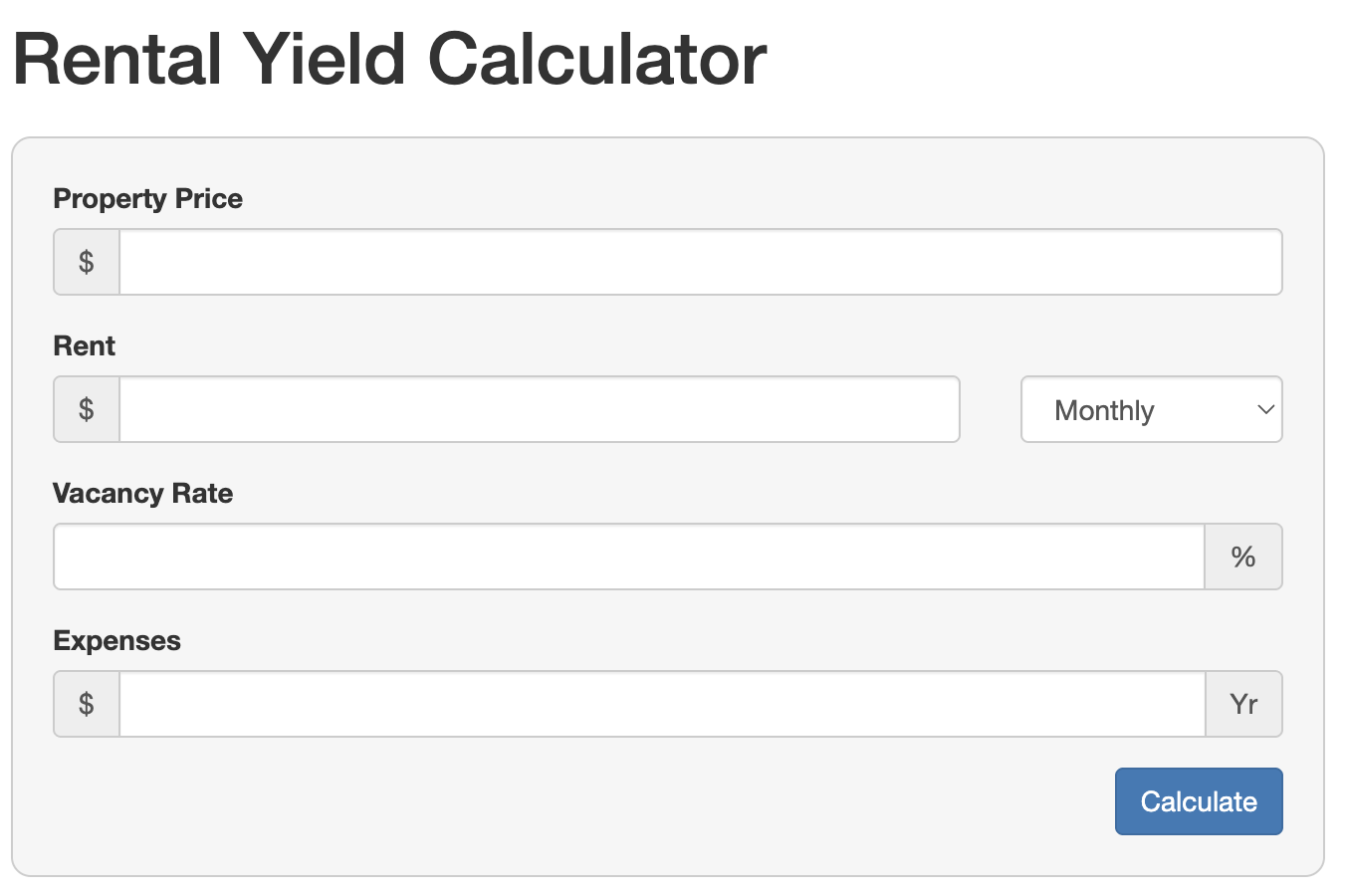

How to Use Rental Yield Calculator

Another easy way to calculate your rental income yield is by using a free online calculator. Here's how to use it:

- Search for “rental yield calculator” online and open any free tool.

- Prepare your numbers:

- Property price (or current value)

- Monthly rent

- Yearly costs (tax, insurance, repairs, management fees, etc.)

- Enter the villa’s price into the calculator.

- Add the monthly rent. If the tool requires yearly rent, simply multiply the monthly amount by 12.

- Include expenses for net yield.

- If there’s an “expenses” field, enter your yearly costs.

- If there isn’t, calculate it yourself using the net yield formula.

- Hit "Calculate"

See Your Potential ROI with Our Free Calculator

Factors Affecting Your Bali Rental Net Yield

Several key factors can influence your final rental yield:

- Operating costs (around 30–40%): You’ll need to account for ongoing expenses such as staff salaries, pool and garden maintenance, utilities, management fees, and general upkeep.

- Location: Being close to the beach, cafés, restaurants, nightlife, gyms, and coworking spaces has a direct impact on how much your property can earn.

- Property type: Villas generally perform better than apartments or standard houses because they attract higher nightly rates and stronger demand.

- Pricing strategy: Using dynamic pricing—especially during peak travel seasons—can significantly boost your annual rental income.

Notice that loan repayments aren’t included here. That’s because net rental yield focuses only on costs tied directly to the property, not your personal financing.

In other words, your mortgage and interest payments are separate from this calculation.

Even if some of these expenses are tax-deductible, you still have to pay for them. Learn more about Bali property taxes system and calculation here: Understanding Bali Property Taxes for Foreign Buyers.

Strategies to Maximize Your Bali Villa Rental Yield

1. Understand the Market

Bali’s property market keeps evolving, and to stay ahead, you need to know what renters and guests are looking for.

From our latest bali real estate trend report, in 2026, people are looking for eco-friendly villas and exploring emerging areas that is considered remain quiet like north bali.

Next, the rise of remote worker or digital nomad is keep flowing. Long-term guest are seeking for properties with comfortable workspaces and reliable internet.

So, investing in a sustainable villas with facilities like co-working space or comfortable hme office can make a big difference for your investment.

Read More: Invest in Bali: A Complete Guide

2. Choose Your Location Wisely

Even if your villa has everything guests want, the wrong location can hurt your bookings and income.

- Short-Term Rentals: Best for tourists who want quick access to attractions. Focus on Canggu, Seminyak, or Uluwatu, where demand is high and rental rates are stronger.

- Long-Term Rentals: Best for expats, digital nomads, or families. Consider Sanur, Ubud, Umalas, or Tabanan (Nyanyi, Kedungu, etc.), where comfort and affordability matter most.

Here’s a simple breakdown of how each area performs

| Area | Gross Yield | Net Yield | Occupancy | Unique Selling Points |

|---|---|---|---|---|

| Canggu & Seminyak | 8–15% | ~10–12% | 70–80% annually | High tourist traffic, premium nightly rates, café culture, beaches, surf, digital nomads. |

| Uluwatu | 9–10% | 7–8% | 65–75% | High-end hotels, strong surf tourism, cliffside luxury villas. |

| Ubud | 4–8% | 3–6% | 60–70% | Yoga retreats, culture, long-stay travelers. |

Smart tips: Once you understand your target audience, choosing the right location becomes easier. Combine this with the right amenities and pricing, and you’ll be set for strong yields.

Read More: 10 Best Areas to Invest in Bali Real Estate 2025

3. Price Strategically

Getting pricing right is one of the smartest ways to maximize your income.

With a little research, you can set a price that works for both you and your guests.

One of our clients has used this tactic and said it worked every time: pretend you’re a potential tenant.

Then, call similar properties near your rental area, gather their pricing, and then set your rate slightly lower.

You can also use local listing platforms like Bali Villa Realty or Airbnb. Look for properties with similar sizes, layouts, and features to your own.

Smart tips: Once your pricing is set, stay flexible:

- If bookings come in quickly, you might raise your rate.

- If demand slows, adjust it or add perks like discounts or small extras, such as free breakfast or airport pickups.

Explore Top Deals: Available Bali Villa For Sale - Leasehold and Freehold!

4. Invest in Amenities Guests Love

Guests don’t always need luxury. They want convenience, comfort, and thoughtful villa amenities that show you’ve anticipated their needs instead.

Imagine this: a guest arrives late at night, tired from their journey.

They open the fridge and find a filter pitcher with fresh water, snacks, and a small note welcoming them to Bali.

These small gestures can make guests happy and encourage them to leave a good review for your property.

They might even be genuinely impressed, become repeat visitors, and recommend your villa to people they know.

5. Leverage Unique Selling Points

Bali is full of beautiful villas. To stand out, highlight what makes yours different. Ask yourself:

- Is your property close to a hidden beach or a lively nightlife area?

- Does your villa feature Balinese craftsmanship, or does it lean toward a sleek modern design?

- Do you offer unique amenities such as an infinity pool, an outdoor shower, or even cooking classes with a local chef?

Once you’ve identified what makes your property special, show it off!

Use your listing descriptions and photos to tell a story about your villa’s uniqueness.

For example, instead of simply saying “Great location,” describe what it feels like to stay in your villa:

“Wake up just steps from Bali’s best surf spots and unwind at nearby organic cafés.”

Make it effortless for guests to imagine themselves there, enjoying something only your property can offer. That’s how your villa becomes the place they want to stay.

6. Optimize Your Listing with High-Quality Photos

Research found that photos are one of the top three things guests look at when choosing a place to stay.

It's because guests don’t just look at photos. They imagine waking up in your villa, lounging by the pool, and relaxing in comfort. That’s the power of great visuals.

In fact, properties with professional photos got 28% more bookings, 26% higher nightly rates, and 40% more overall earnings.

The right visuals don’t just sell a room; they sell the entire experience.

Challenges to Maintain a Strong Rental Yield

Almost every villa investor eventually faces similar challenges when trying to maximize their rental returns. Here are the most common ones and how to handle them:

1. High Operating Costs

Running a villa isn’t cheap. That’s why choosing the right design, layout, and build quality from the start is so important.

A well-designed property reduces long-term maintenance expenses and helps you avoid unnecessary renovation costs later.

Read More: Why More Bedrooms Mean Bigger Profits for Your Bali Villa Investment

2. Seasonality

Income naturally shifts between low and high season. Many first-time investors struggle with this and aren’t sure how to navigate it.

But you don’t need to figure it out alone. Our experts at Bali Villa Realty can help you choose locations and property types with historically strong, year-round occupancy.

3. Dependency on Good Management

Your rental results depend heavily on how well your villa is managed.

You can hire an independent villa management company.

Or, if you prefer something more streamlined, you can use Bali Villa Realty’s in-house management service for a smoother, all-in-one experience.

4. Legal and Permit Issue

Incorrect or incomplete documents can severely impact your rental yield. Always make sure the villa has clear titles, correct zoning, proper lease agreements, and valid building permits.

Bali Villa Realty’s in-house legal team can conduct thorough due diligence for you, and our partner notaries can handle the entire transaction legally and safely.

5. Price and Yield Compression

Your villa yields can tighten as the prices increases, so, be careful.

Our experienced agents offer accurate market valuations to help you stay profitable. You can book a free, no-commitment, consultation anytime and ask anything you need to know.

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Conclusion

A healthy rental yield typically falls around 6–8%, but the exact number always depends on your villa’s location and market conditions.

You can calculate your gross and net rental yield using the formulas we shared earlier, or simply use a free online calculator.

But above all, getting the best yield requires smart, strategic villa management. And doing it alone can feel overwhelming.

Don’t worry, Bali Villa Realty is here to guide you from the very beginning.

We’ve helped investors from all over the world invest in Bali with confidence and ease.

Feel free to reach out to our agents anytime to ask questions, get a personalized investment plan, or explore the best property opportunities available today.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

1. Is owning a villa in Bali profitable?

Yes, it can definitely be profitable. Many owners are successfully earning income from renting out their villas in Bali.

2. What is the 2% rule for property?

The 2% rule suggests that a rental property should bring in monthly rent equal to at least 2% of its purchase price. It’s a common guideline investors use to quickly gauge whether a property has good income potential.

3. How much is it to own a Bali villa?

- Seminyak/Canggu: $300,000 – $1,000,000 for mid-sized villas.

- Ubud: $200,000 – $600,000 for villas surrounded by nature.

- Sanur/Nusa Dua: $150,000 – $400,000, popular with retirees and long-term expats.

- Tabanan (Nyanyi, Kedungu, etc.): $100,000 – $300,000 for larger land plots in more rural settings.

4. What is ROI in Bali on renting properties?

On average, rental properties in Bali give an ROI of 7–12% per year. In popular prime areas, ROI can even reach up to 20%.