Key Takeaways Flood risk in Bali is driven by both extreme weather and rapid development, making location, terrain, and drainage critical factors for safe property investment. High-ground and limestone areas such as the Bukit Peninsula, Sanur, Sidemen, and parts of North Bali consistently perform better during heavy rain and offer lower structural and rental risk. Proper land zoning...

Blog

Key Takeaways Off-plan properties offer lower entry prices, typically 10–30% below completed villas, with potential capital gains during construction. Investors can earn from two sides: early price appreciation before completion and steady rental income once operational (often 7–12% net ROI). Developer track record and contract structure are critical in off-plan investment. Payments should...

Disclaimer: This article is for informational purposes only. Readers are advised to consult a senior advisor before making decisions. We are not responsible for any decisions or actions taken based on this information. Key Takeaways Umalas offers up to 15% ROI, with rising ADR (32.84% increase from 2021 to 2023) and strong rental demand, especially in peak months like July–August. Top...

Key Takeaways 2026 is still a good time to invest in Bali property, but the market is more mature and strategic than before. Investing early in the right locations can lock in better value before prices adjust upward. That's why now is the best time to invest. 2026 is not “easy money”: competition is higher, and success requires strong location choice, realistic returns, and professional...

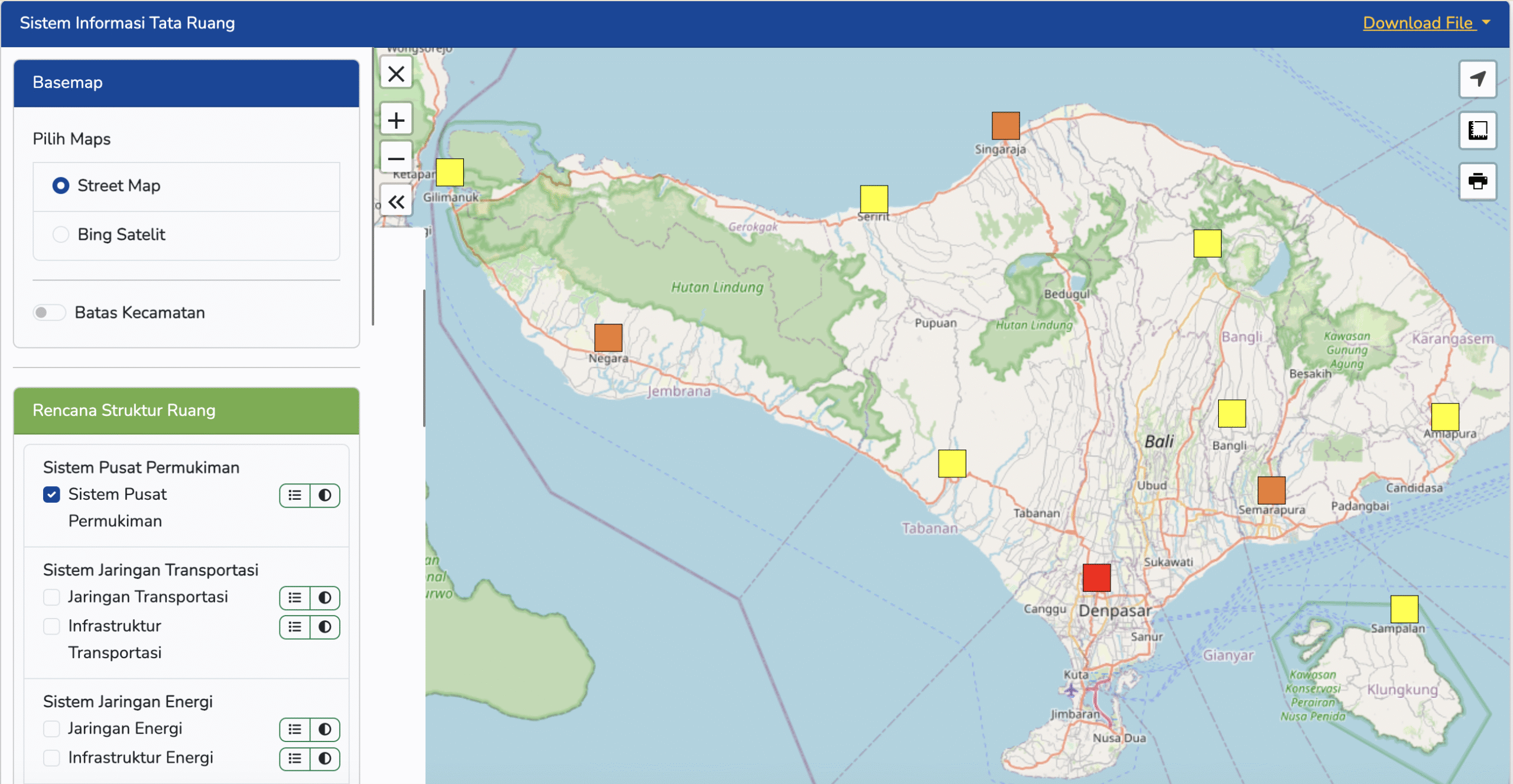

Key Takeaways Bali land zoning determines what you can legally build and how a property can be used, making it one of the most important checks before buying land or a villa. Bali’s zoning system is color-coded, with six main zones (Green, Yellow, Pink, Red, Orange, and Conservation), each described as follows: Zone Name (EN / ID)Main UseExplanationGreen Zone (Zona Hijau)Agriculture &...

Key Takeaways Slow and immersive travel dominates Bali in 2026. Visitors are choosing quieter, culturally rich, and nature-focused destinations like Amed, Sidemen, Seraya, Penglipuran, and Menjangan Island, beyond the usual crowded spots. Eco-friendly and sustainable tourism is on the rise. More travelers prefer eco-conscious villas, which also offer higher long-term property value. Undeveloped...

Disclaimer: This article is for informational purposes only; prices and figures may change due to market conditions. We recommend speaking with a senior advisor before making any final decisions. Key Takeaways Villa rental prices in Bali vary by stay length: Short-term stay (few days/weeks): $100 - $500 (IDR 1.57M - 7.85M) Long-term stay (monthly): $1,000 - $5,000 (IDR 15.7M - IDR...

Discover the ins and outs of buying real estate in Bali as an expat with our comprehensive guide. Learn about ownership, legalities, and the cost of owning a villa.

Key Takeaways Bali’s high season peaks in July–August and late December to early January, around Christmas and New Year. Bali’s low season typically runs from November through March, aligning with the rainy season. Bali’s tourism remained strong in 2025, with international arrivals reaching around 6.8 million by late December, despite a temporary slowdown in domestic travel during low...

Key Takeaways Newly built villas are completed properties ready to rent. Pros: immediate income and lower risk. Cons: higher prices, limited customization, and slightly compressed yields in hotspots. Off-plan villas are bought during construction. Pros: lower entry price and higher upside. Cons: construction delays, delayed income, and developer risk. New villas suit investors seeking stable...