Ubud isn’t just Bali’s cultural heart—it’s now one of the hottest spots for property investors.

With more travelers seeking wellness, culture, and nature instead of beach parties, demand for villas in Ubud has never been higher.

So, what does this mean for investors? Discover the opportunities of investing in Ubud in this complete guide and see if it aligns with your investment goals.

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Key Takeaways

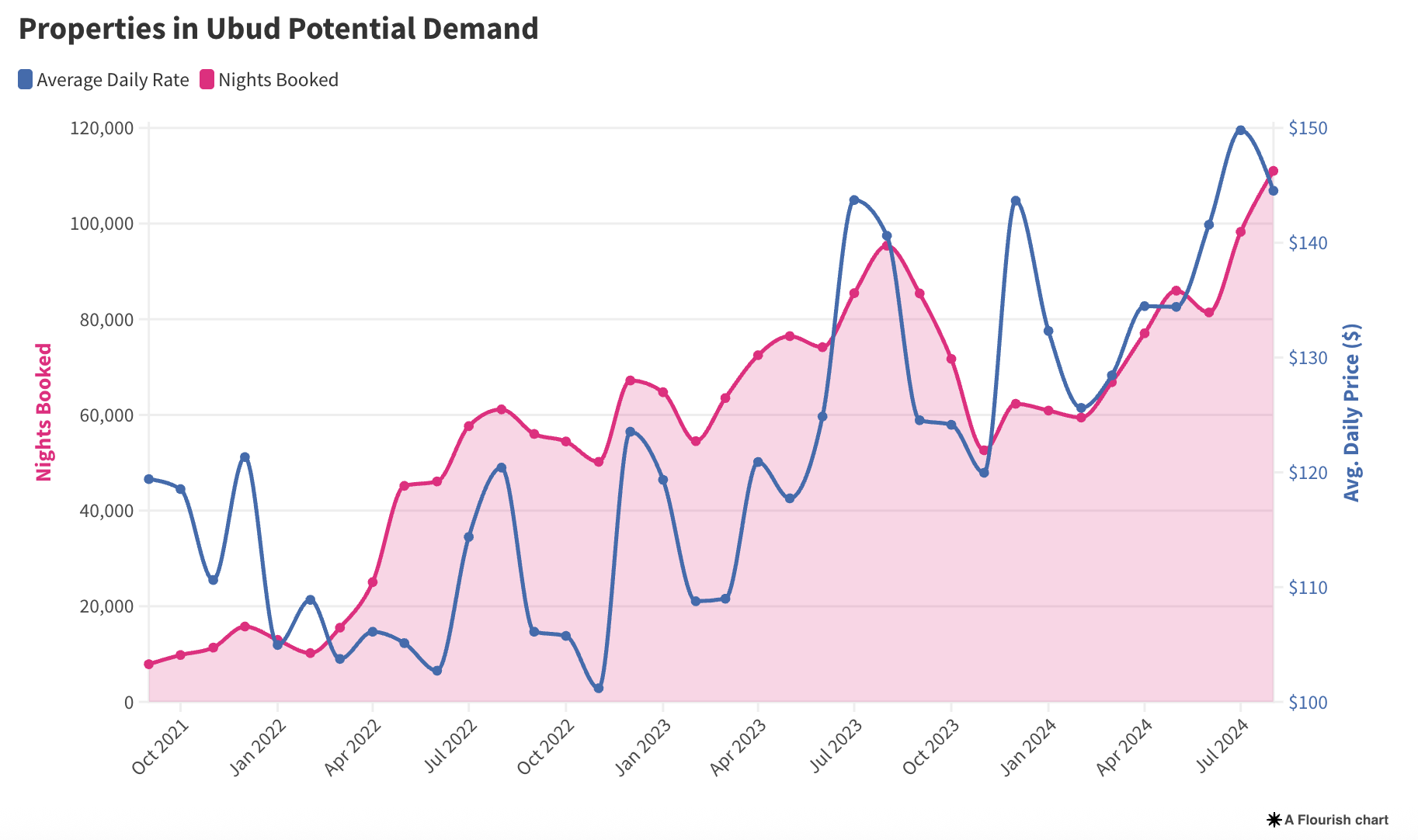

- ADR in Ubud rose 25% in 3 years, from $119.41 (2021) to $149.80 (July 2024).

- Occupancy peaks in July–August with over 111,000 nights booked in August 2024. Even in the low season, ADR remains solid ($125.61 in Feb 2024).

- Year-round demand in Ubud comes from digital nomads, wellness seekers, families, and cultural travelers, with bigger villas consistently earning more.

- The best areas to invest in Ubud include Tegallalang, Penestanan, Kedewatan, and Sayan.

Explore Top Deals: Available Bali Villa For Sale - Leasehold and Freehold!

Ubud’s Growing Demand for Rental Properties

Ubud’s tourism continues to grow, making it one of the top choices for property investment. More visitors are looking for experiences beyond Bali’s beaches, and Ubud’s culture and wellness scene are big reasons why.

This growing demand also means higher potential for rental income:

- The Average Daily Rate (ADR) in Ubud has been rising steadily. According to Oniriq Property reports, ADR went up by about 25%, reaching $149.80 in July 2024, compared to $119.41 in September 2021.

- The highest ADR recorded was $149.80 in July 2024, right in the peak tourism season.

- Even during the low season, like February 2024, ADR stayed solid at $125.61.

High and Low Seasons in Ubud

- Bookings also keep climbing, especially in summer. August 2024 saw 111,023 nights booked, showing Ubud’s strong appeal.

- The busiest times are July and August, which line up with school holidays:

- July 2023: 85,460 nights booked → grew to 98,280 in July 2024

- August 2023: 95,379 nights → grew to 111,023 in August 2024

- While ADR shifts through the year, it stays competitive:

- May 2024 ADR: $134.41 (high for an off-peak month)

- December 2023 ADR: $143.66 (peak pricing)

- February 2024 ADR: $125.61 (quieter month)

Even in slower seasons, Ubud’s revenue remains strong.

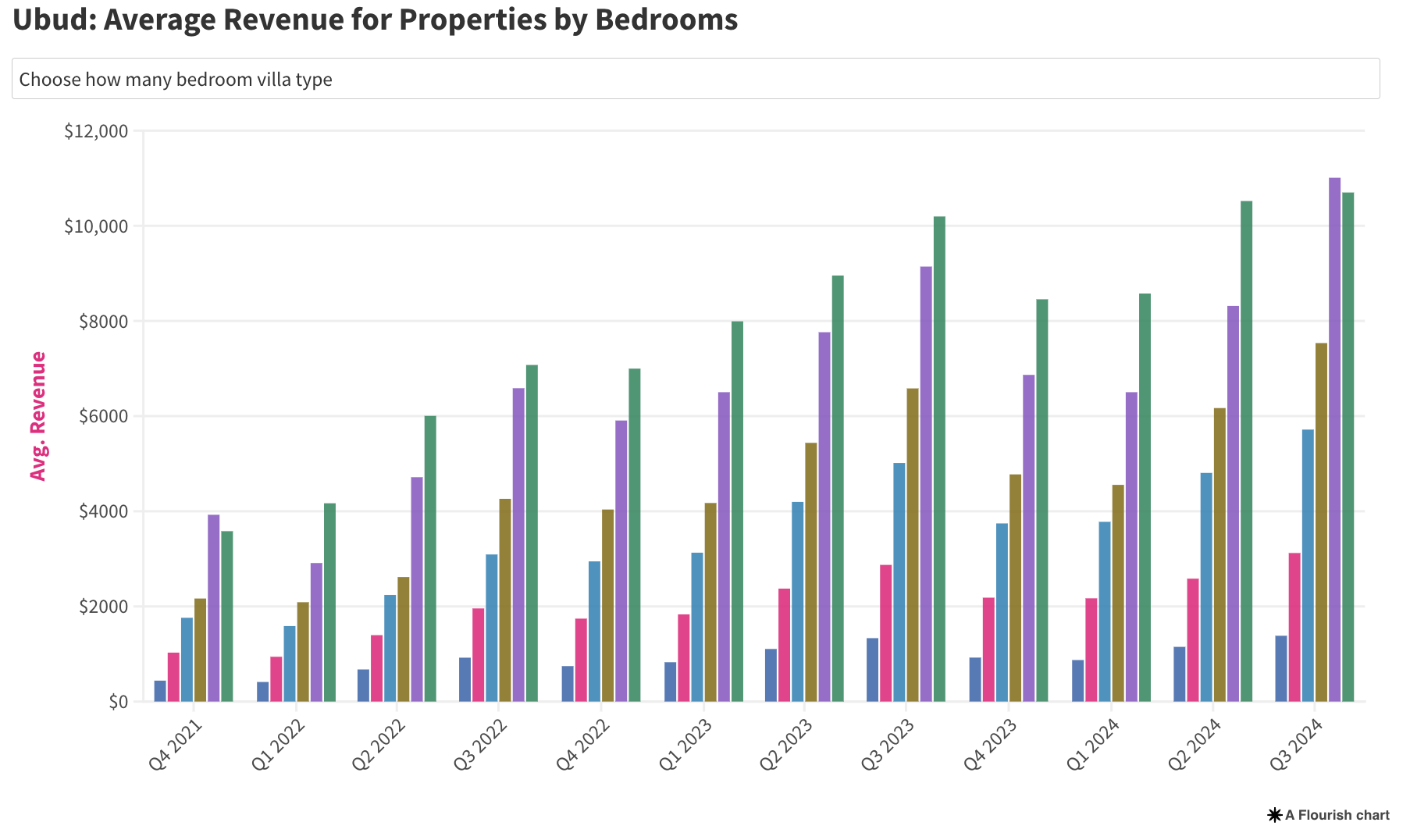

In Q1 2024, for example, 1-bedroom villas earned $872.23, while 5-bedroom villas made $6,502.86. This proves Ubud is a reliable year-round market for investors.

Profits for Different Villa Types in Ubud

- 1-bedroom villas: $439.57 in Q4 2021 → $1,383.07 in Q3 2024 (+214%)

- 2-bedroom villas: $1,028.25 in Q4 2021 → $3,122.28 in Q3 2024 (+203%)

- 4-bedroom villas: $2,166.12 in Q4 2021 → $7,535.49 in Q3 2024 (+247%)

- 5-bedroom villas: highest revenue, reaching $11,011.23 in Q3 2024

- 6-bedroom villas: $3,581.61 in Q4 2021 → $10,700.59 in Q3 2024 (+198%)

It’s important to note that bigger villas consistently generate more income than smaller ones in Ubud.

Read More: Invest in Umalas Villas: What You Need to Know

Why Invest in Ubud?

There are plenty of reasons why buying a property in Ubud is a smart move. Here are some of the main ones:

- Ubud is a top tourist spot: With its stunning scenery, rich culture, and many wellness and spiritual retreats, Ubud attracts visitors from all over the world. This constant flow of tourists creates high demand for villas.

- Property values keep growing: Ubud’s real estate market is expanding quickly. Villas here often rise in value over time, meaning you could make a good profit if you sell later.

- Strong rental income potential: If you don’t plan to stay full-time, you can rent your villa to tourists. This can cover costs and even bring in extra profit.

- A beautiful place to live: Ubud isn’t just for investment—it’s also a wonderful place to call home. It’s peaceful, surrounded by nature, and full of chances to experience Balinese culture and spirituality.

Read More: Invest in Seminyak: Insider Look at High Returns & Luxury

Who Comes to Ubud?

If you’re planning to invest in Ubud, make sure your villa appeals to these types of renters:

- Digital nomads

- Yoga and wellness retreat guests

- Families

- Cultural travelers

These visitors value peace and authentic experiences, not just parties. That’s why Ubud’s rental market is resilient, profitable, and less risky.

The Best Areas to Invest in Ubud

When it comes to property, location is everything. Ubud offers a mix of lively central spots and quiet villages nearby. Here are some of the top areas to consider:

1. Tegallalang: Iconic Rice Terrace Views

Tegallalang is a village in Gianyar, about 8 km from Ubud town. Known for its UNESCO-listed rice terraces, this area has a cooler climate and is extremely popular with tourists.

Pros:

- World-famous views, allowing for premium rental prices

- Strong tourist demand year-round

- Land prices still lower than central Ubud

Cons:

- Can get crowded during peak hours

- Some roads are narrow and less accessible

2. Penestanan: The Artistic Expat Enclave

Just outside Ubud’s center, Penestanan has long been home to artists and expats. The area is filled with art studios, yoga shalas, and healthy cafés, and you can easily walk to Ubud town while enjoying a relaxed vibe.

Pros:

- High demand for long-term rentals

- Established expat and digital nomad community

- Less traffic than central Ubud

Cons:

- Smaller land plots that are harder to find

- Prices have risen due to popularity

Read More: Ubud or Sanur: Which One is Better for You?

3. Kedewatan: Luxury on the Ayung River

Kedewatan is where you’ll find many of Bali’s top five-star resorts, offering a secluded and exclusive feel. The area is known for fine dining, luxury spas, and breathtaking views of the jungle and the Ayung River.

Pros:

- Attracts high-end guests

- Premium rental rates and ROI potential

- Luxury brands already established here

Cons:

- Higher land and construction costs

- Requires a large upfront investment to compete

4. Sayan: The Best of Both Worlds

Sayan Ridge combines dramatic river valley and jungle views with easy access to Ubud town. It’s known for its luxury villas, resorts, and unforgettable sunset views—a perfect blend of nature and convenience.

Pros:

- One of Ubud’s most prestigious addresses

- Strong potential for capital appreciation

- Appeals to both short-term and long-term renters

Cons:

- Land prices are high

- Prime plots are becoming harder to secure

Ready to call Ubud home? Explore Bali Villa Realty's handpicked selection of available properties here.

Conclusion: Start Investing in Ubud Today

Coastal areas may bring fast growth, but Ubud offers something more sustainable:

- A market driven by culture and wellness

- Steady rental demand with stable occupancy

- Long-term property value appreciation

If you’re looking for stability, strong ROI, and a property that truly feels meaningful, Ubud is an excellent choice.

Still have questions or thinking about investing in Ubud? Our expert agents are ready to help—completely free of charge.

Click below to book your free, no-obligation consultation anytime.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

1. Where is the best place to invest in Bali?

- Canggu: Known for strong rental demand and a lively lifestyle.

- Uluwatu: Best for surf lovers and premium ocean-view villas.

- Ubud: Great choice for culture, wellness, and retreats.

- North Bali: More affordable entry point with long-term growth potential.

2. Is Bali still a good investment?

Yes, Bali remains an attractive investment market. Rental yields can reach around 15% of the purchase price, far above the global average of about 5%.

3. Is it better to buy or rent in Bali?

It depends on your goals, budget, and lifestyle. Renting gives flexibility to try different areas of the island, while buying suits those who want to invest or build a long-term home.