Disclaimer: This article is for informational purposes only. Prices and figures may change due to market conditions. We recommend speaking with a senior advisor before making any final decisions.

Key Takeaways

- Building a Bali property portfolio means owning multiple assets (villas, land, or apartments) to generate rental income, grow capital value, and spread risk across different areas and property types.

- Start by setting clear investment goals and choosing the right area based on your target market (short-term rentals, long-term income, or land appreciation). Your first purchase must match your strategy.

- If you’re starting with limited capital, use smart entry methods like off-plan payment structures (20–30% down payment), developer installment plans, or partnering with investors who provide capital while you contribute skills or market access.

- Reinvest rental income from your first property to fund the next one. Over time, each asset supports the growth of your portfolio.

- Track performance like a portfolio manager—monitor occupancy, expenses, cash flow, and ROI regularly so you scale based on real numbers, not assumptions

Investing in Bali property is not just about buying one villa and hoping it goes up in value. If you want steady income and long-term growth, you need to build a property portfolio.

A property portfolio means owning more than one investment property. These properties can be villas, apartments, or land. The goal is simple:

- Generate rental income

- Grow property value over time

- Spread risk across different areas and property types

This is very important in Bali because the market depends on tourism seasons, global trends, and location demand.

So how do you actually build a real estate portfolio in Bali, especially if you’re starting from zero? Let’s break it down step by step.

1. Research the Market and Set Goals

Before buying anything, understand where and why you are investing. Different areas in Bali serve different markets. For example:

| Area | Main Target Market | Why People Choose This Area | Rental Style | Risk Level | Growth Potential |

|---|---|---|---|---|---|

| Canggu | Digital nomads, young expats, short-term tourists | Trendy cafés, beach clubs, surfing beaches, strong lifestyle appeal | Short-term rentals (Airbnb-style villas) | Medium | High – Strong demand and ongoing development |

| Ubud | Wellness travelers, retirees, long-stay expats | Jungle views, yoga retreats, cultural atmosphere, quieter environment | Long-term and retreat-style rentals | Low–Medium | Stable – Slower growth but consistent demand |

| Uluwatu | Luxury travelers, surfers, high-end tourists | Cliff-top ocean views, premium villas, sunset spots | High-end short-term rentals | Medium–High | High – Growing luxury segment |

| Sanur | Families, retirees, mature expats | Calm beaches, international schools, hospitals, established area | Long-term rentals | Low | Stable – Steady appreciation and reliable income |

| Tabanan | Early investors, land buyers, future developers | Lower land prices, emerging infrastructure, quiet surroundings | Land banking, future villa development | High | Very High – Early-stage growth area |

| Seminyak | Lifestyle tourists, shopping-focused visitors | Central location, restaurants, shopping, nightlife | Short-term rentals | Medium | Moderate – Mature market, limited new land supply |

Next, don’t forget to define your goals and budget. Do you want passive rental income, long-term appreciation, or fast cash flow? This will help you decide which asset is best to buy.

If you want fast cash flow, choose a turnkey villa for sale in Canggu. If you prefer steady long-term growth, it may be better to buy land in Tabanan before prices rise.

You can also aim for diversification, like mixing low-risk rentals with higher-reward land investments. For more insight, you can explore our Bali property diversification strategies.

2. Understand Legal Options as a Foreigner

This is the most important part. Foreigners cannot directly own freehold land in Indonesia. So, you have two common legal options: leasehold or setting up a PT PMA (which requires a minimum IDR 10B investment plan for stronger land rights).

Always avoid nominee arrangements. They may look cheaper, but they are legally risky and often lead to serious problems. Remember, legal security protects your entire portfolio.

3. Secure Financing

Foreigners usually cannot get traditional mortgages from Indonesian banks for property purchases in Bali. However, there are still several ways to secure financing:

- Use cash or funds from overseas, including savings, business profits, or asset sales.

- Use equity from property in your home country. For example, refinance your home or take a home equity loan, then use the funds to buy a leasehold villa in Bali, often benefiting from lower interest rates in your home country.

- Use installment payment plans from developers, especially if you invest in off-plan projects.

4. Buy or Build Your First Property

Your first deal matters the most, and it must align with your goals. You can either choose a turnkey villa (if you want quick income) or decide to build a property yourself (to reduce costs and potentially increase returns).

Read More: Built vs Off-Plan Villas Investment in Bali, Which One is Better?

5. Manage and Generate Income

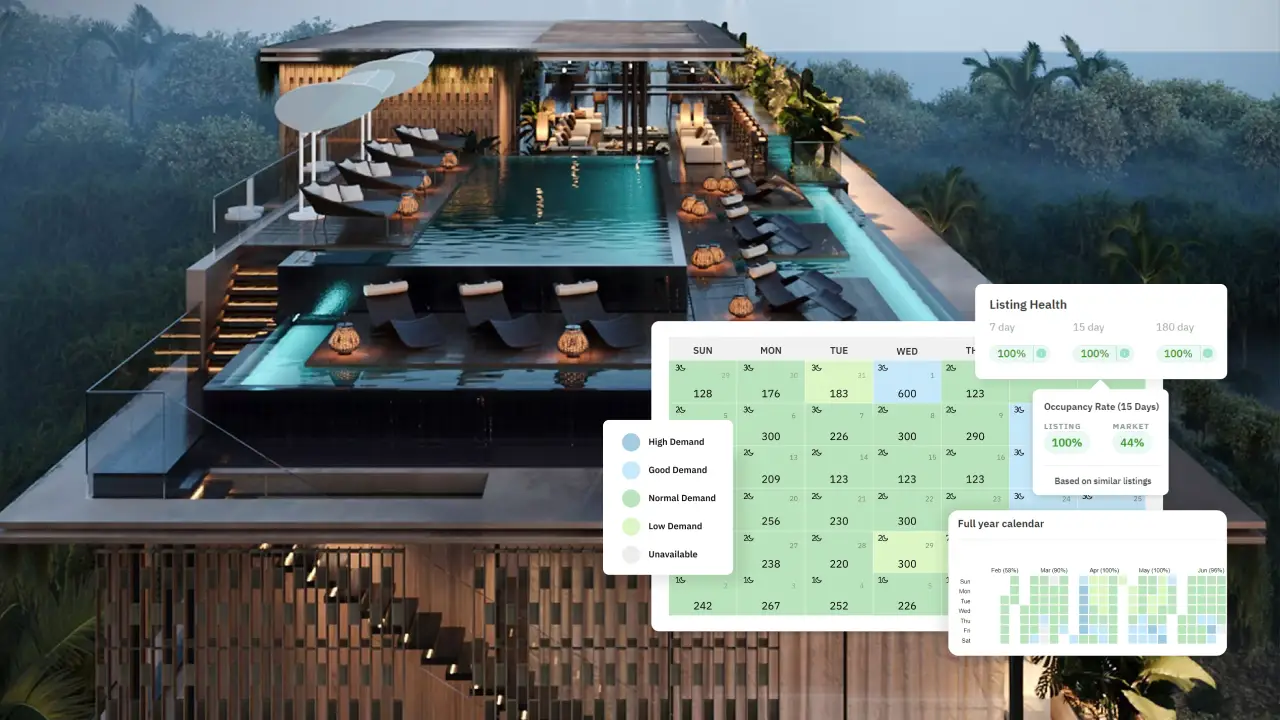

Buying a villa is just the first step. To actually generate income, you need to operate your property like a business. There are many options available, but for this example, let’s assume you’re using your villa for short-term rental like Airbnb.

Short-term rental yields in Bali commonly range from 5–15%, depending on the area and management quality. It can be higher if your villa has strong design appeal and a good location. The higher your occupancy rate, the more profit you generate.

Some key metrics to track when monitoring your property performance include:

- Occupancy rate

- Average nightly rate

- Maintenance costs

- Guest reviews

6. Scale and Diversify Fast

After your first property performs well, start reinvesting. There’s no single formula for scaling, and investors are free to choose the type of real estate mix they want in their portfolio.

For example, you can start with one villa in Canggu. After three years, you buy land in Tabanan. Three years later, you add a long-term rental in Sanur. In seven years, you already own three valuable properties in different segments.

| Strategy | Risk Level | ROI (Estimation) | Best Area |

|---|---|---|---|

| Long-term Rentals | Low | 6-8% | Sanur/Ubud |

| Land Flips | High | Up to 15%+ | Tabanan |

| Short-term Villas | Medium | 10-12% | Canggu |

This mix helps protect you from seasonal slowdowns.

How to Build a Property Portfolio with No Money

Many people are interested in building a property portfolio with no money. Can you really do that? Yes.

But honestly, “no money” doesn’t mean literally zero cash. It means using smart strategies. Here are some common ways investors get started:

Off-Plan Payment Structure

One strategy is investing in off-plan projects. You typically pay 20–30% as a down payment and the rest in stages during construction.

For example, if an off-plan villa in Canggu costs $300K (IDR 5B), you would pay around 20% or $60,000 (IDR 1B) as a down payment. The remaining balance is spread over 12–18 months, giving you time to prepare the funds.

Read More: Investing in Off-Plan Villa Bali 2026: Pros, Cons, and ROI

Developer Financing

Some developers in Bali offer installment payment plans, especially for off-plan projects. In some cases, they may offer flexible terms during early-bird sales to secure buyers before construction progresses.

However, always review the developer’s track record, legal permits, and project timeline before committing. Developer financing works best when the project comes from a reputable builder with clear legal documentation.

Partner with Investors

If you don’t have enough capital, partnering with investors can be a smart way to start. In this structure, you contribute value beyond money.

For example, you may bring market knowledge, project management skills, local connections, or the ability to source strong deals before they reach the public market. Your investor partner provides the capital needed to purchase or develop the property.

Profits are shared based on an agreed structure, such as a 50/50 split or preferred returns for the capital partner. This model is common in real estate worldwide.

Reinvest Rental Income

Some expats leverage assets they already own. If your first villa generates $30,000 (IDR 505M) - $40,000 (IDR 673M) in Net Operating Income (NOI) per year, then within 3–4 years, you may have enough for your next down payment.

Over time, each property begins to support the next acquisition. That’s simply how portfolios grow.

Read More: Managing Your Bali Investment Property from Abroad: Expert Tips

Property Portfolio Template

It’s also helpful to have your own property portfolio template. Here’s an example you can use to track and manage your Bali investments:

1. Property Overview

| Item | Details |

|---|---|

| Property Name | |

| Location (Area) | |

| Property Type (Villa/Land/Apartment) | |

| Ownership Type (Leasehold/PT PMA) | |

| Lease Duration / Expiry | |

| Land Size (sqm) | |

| Building Size (sqm) | |

| Year Built / Completion | |

| Developer / Builder | |

| Exit Strategy (Sell / Hold / Refinance) |

2. Acquisition Details

| Item | Amount |

|---|---|

| Purchase Price | |

| Legal & Notary Fees | |

| Renovation / Furnishing Cost | |

| Total Investment Cost | |

| Payment Structure (Cash / Installment) | |

| Down Payment | |

| Remaining Balance |

3. Financing Structure

| Item | Details |

|---|---|

| Financing Type (Cash / Loan / Partner) | |

| Loan Amount (if any) | |

| Interest Rate | |

| Loan Term | |

| Monthly Loan Payment | |

| Investor Profit Split (if partnered) |

4. Rental Performance

| Item | Amount |

|---|---|

| Rental Type (Short/Long Term) | |

| Average Nightly / Monthly Rate | |

| Occupancy Rate (%) | |

| Gross Annual Income | |

| Management Fees | |

| Operating Expenses | |

| Net Operating Income (NOI) | |

| Net Yield (%) |

5. Operating Expenses Breakdown

- Staff salaries

- Utilities (electricity, water, internet)

- Maintenance & repairs

- Marketing / Airbnb commission

- Insurance

- Property tax

- Management fee

6. Performance Metrics

| Metric | Result |

|---|---|

| Cash Flow (Monthly) | |

| Cash Flow (Annual) | |

| ROI (%) | |

| Payback Period (Years) | |

| Capital Appreciation (%) |

7. Maintenance & Notes Log

| Date | Issue | Cost | Status |

|---|---|---|---|

How to Use This Template

This template helps you think like a portfolio manager, not just a property buyer. Here's how to use it:

- Update income and expenses monthly.

- Review performance every 6–12 months.

- Compare yields across properties.

- Identify which assets perform best.

- Plan reinvestment using real numbers, not estimates.

Why Bali Is Attractive for Portfolio Investors

Bali continues to attract investors for several strong reasons. Tourism remains steady, and visitor numbers are healthy across major hotspots. In 2025, Bali welcomed around 6.9 million foreign visitors, according to BPS data.

At the same time, the expat community keeps growing, especially in lifestyle-driven areas like Canggu, Uluwatu, and Ubud. This creates consistent rental demand throughout the year, not just during peak holiday seasons.

In many Bali prime areas, annual price growth has averaged around 5–10% in strong-performing zones. Well-managed villas can generate net rental yields between 6–12%, depending on location, design quality, and management efficiency. Compared to many major global cities (like Hawaii), these numbers remain attractive.

Conclusion

There you have it. A clear path on how to build a property portfolio in Bali from scratch. So start small, stay legal, and scale smart.

Need further help building your Bali investment portfolio? Our property specialists at Bali Villa Realty are here to help.

Book your free consultation today, and we’ll create a personalized plan based on your goals and needs.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

The 60/20/20 portfolio strategy with gold represents a fundamental departure from traditional asset allocation. It consists of 60% equities, 20% fixed income, and 20% precious metals

The 7% rule in real estate is a general guideline investors use to estimate whether a rental property may provide a solid return. It suggests that the annual gross rental income should be at least 7% of the property’s purchase price.

The most profitable businesses in Bali are centered around the tourism sector, including luxury villa rentals, property management, F&B, and wellness. For further ideas, refer to our article: Most Profitable Business to Invest in Bali for Foreigners (2026 Update)

On average, based on our observation, a budget range of $350,000 – $1,400,000+ (IDR 5.88B – IDR 23.52B+) can get you a proper villa with full amenities (up to 4–6 bedrooms). However, remember that actual villa prices may vary for different reasons.