Price bubbles often happen in property markets. A "bubble" means the price of a property is much higher than its real value, but you can only be sure it was overpriced once the bubble bursts.

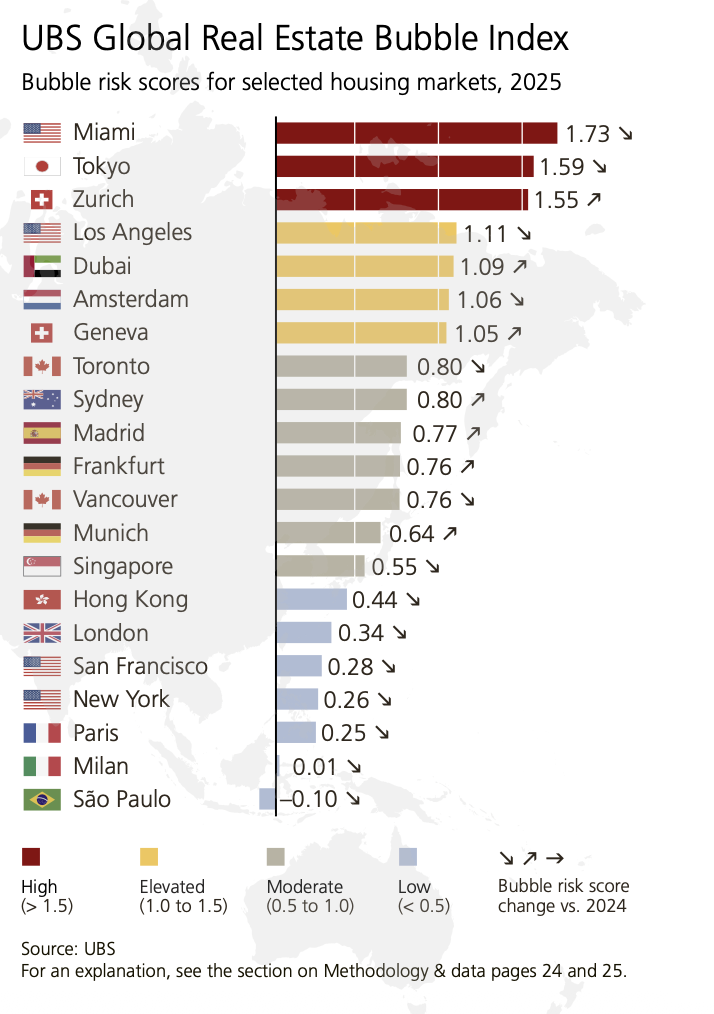

According to the latest UBS Global Real Estate Bubble Index 2025, several international cities are showing signs of housing bubbles, where property prices are rising much faster than local incomes and rents.

For property buyers and investors, these global signals are important to understand.

So, what do they mean for Bali’s property market? Could the island face similar risks, or does it offer a different kind of opportunity? Let’s find out here.

Key Takeaways

- The UBS Global Real Estate Bubble Index 2025 shows housing markets worldwide cooling for the third year, with high mortgage costs, limited construction, and rising affordability issues.

- Cities like Miami, Tokyo, Zurich, and Dubai face higher bubble risks, while others such as London and Paris show more stability. Property prices in many global cities continue to rise faster than rents and incomes.

- Unlike overheated global cities, Bali’s market is becoming more structured and data-driven. Compact villas (1–2 bedrooms) make up over 62% of sales, and off-plan projects account for around 37% of listings, showing steady yet cautious investor confidence.

UBS Global Real Estate Bubble Index: Key Findings

The UBS Global Real Estate Bubble Index 2025 highlights several key findings:

- Global Market Slowdown: Housing markets around the world have cooled for the third consecutive year.

- High Mortgage Costs: Borrowing remains expensive as mortgage rates stay elevated.

- Slower Construction: New housing developments are declining, adding pressure to supply.

- Affordability Challenges: Homeownership remains out of reach for many buyers due to rising prices and stagnant incomes.

- Rising Price Gap: Housing prices in several global cities are increasing much faster than rents and incomes—a classic sign of market overheating and potential bubbles.

- Changing Risk Levels: Bubble risks have eased in cities like Miami, Tokyo, Toronto, and Hong Kong, but have risen sharply in Dubai and Madrid.

Here’s how all of the cities are grouped by risk level:

| Risk Level | Cities |

|---|---|

| Highest Risk | Miami (top of the list), Tokyo, Zurich, Los Angeles, Dubai, Amsterdam, Geneva |

| Moderate Risk | Singapore, Sydney, Vancouver, Toronto, Madrid, Frankfurt, Munich |

| Low Risk | London, Paris, Milan, Hong Kong, San Francisco, New York, São Paulo (lowest risk overall) |

Property Valuation: Price-to-Income

In most big cities, a 60 m² (650 ft²) apartment is far too expensive for the average worker:

- Hong Kong is the least affordable. It takes about 14 years of income to buy one.

- Paris, London, and Tokyo are also very costly, with prices more than 10 times local incomes.

- Other pricey cities include Zurich, Sydney, Geneva, Munich, and São Paulo.

Since interest rates rose after 2021, the average worker can now afford about 30% less space. Current prices look especially hard to sustain in New York, Sydney, and London.

Even if buyers qualify for loans, high mortgage rates make monthly payments heavy, even in U.S. cities with lower price-to-income ratios.

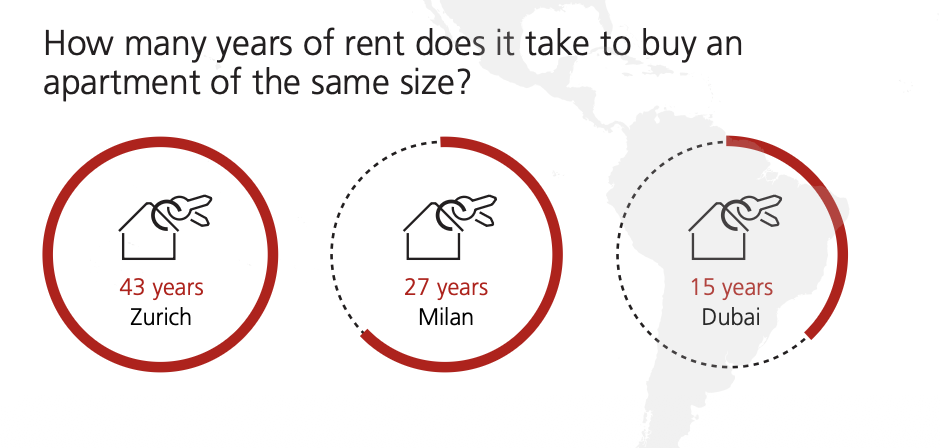

Property Valuation: Price-to-rent

Price-to-rent multiples show how many years of rent it takes to buy an apartment. Over the past 3 years, these multiples dropped in most European and Asia-Pacific cities (except Tokyo) because rents rose faster than home prices.

Zurich, Munich, Geneva, Frankfurt, Tokyo, and Hong Kong are the most expensive, with ratios near or above 30. This shows people expect big future price gains, even if rental income is low. If expectations fall, these markets could face sharp losses.

Dubai, São Paulo, and U.S. cities have lower multiples. This is due to freer rental markets, higher interest rates, and added risk in places like Dubai and São Paulo.

Bali’s Property Market in the Global Context

So, what about property investment in Bali? According to REID (Real Estate Indonesia Data), the Bali property market at the start of 2025 is showing signs of maturity and recalibration.

The market is becoming more data-driven, structured, and cautious. Here are some key takeaways:

1. Compact Properties Lead the Market

Big villas are no longer the standard. One- and two-bedroom villas now make up over 62% of property sales in early 2025.

Average build sizes are down 3.2% year-on-year, showing a clear shift toward smaller, more efficient homes.

With 1-bedroom villas priced at USD 160,000 and 2-bedrooms at USD 245,000, compact properties are more affordable, easier to rent, and faster to resell—the new "smart buy" for investors.

Explore Available Bali Villas: 1- to 6-Bedroom Villas for Sale (Leasehold & Freehold)

2. Off-Plan Properties Surge

Off-plan listings now represent 37% of Bali’s total market, up 180% from last year. Developers remain confident, but supply is growing fast.

Off-plan units cost more per square meter than completed ones, meaning buyers are betting on future value and timely delivery. Therefore, investors should stay selective—rapid expansion brings opportunity but also higher risk.

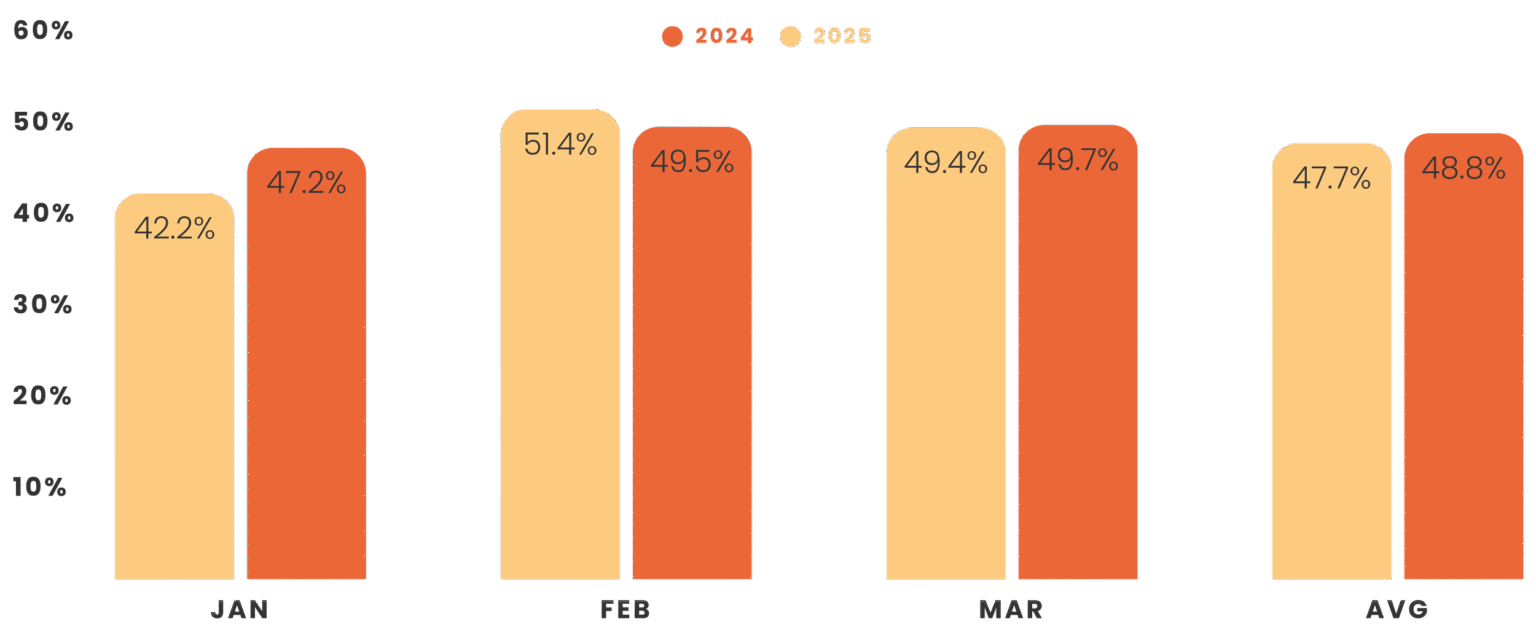

3. Rental Market: More Bookings, Lower Revenue

Rental occupancy is up 2.3% YoY, but revenues dropped by 16%, with average nightly rates down 12%.

More listings mean more competition, especially for mid-sized 3-bedroom villas in emerging areas like Mengwi.

Still, the rise of professionally managed rentals (+30%) shows owners are adapting through better operations and marketing.

4. Apartments and New Structures Gaining Ground

Apartments now make up 12% of Bali’s total property supply, a 56% jump year-on-year.

These compact developments attract budget-conscious and urban investors, reflecting a growing demand for affordable, performance-driven real estate.

Villas still dominate, but apartments and townhouses are quickly gaining traction.

Read More: Bali vs. Thailand: Which Offers the Best Property Investment?

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

What Happens when a Housing Bubble Bursts?

A housing bubble means that property prices are unsustainably high. But when it bursts, home prices can drop sharply within a short time. Here’s what usually happens next:

- Negative Equity: Many homeowners end up owing more than their property’s market value.

- Foreclosures: Loan defaults rise, flooding the market with more homes and pushing prices down further.

- Hard to Sell: Owners struggle to recover their investment, with some “underwater” on their mortgages.

- Tougher for New Buyers: Prices fall, but stricter lending rules and job insecurity make buying harder.

- Banking Crisis: Lenders holding risky mortgages face major financial losses.

- Economic Recession: A housing crash can spread into the wider economy, reducing spending and growth.

- Job Losses: Construction and real estate slowdowns lead to layoffs and higher unemployment.

Conclusion: Invest Smarter and Gain More

The UBS Global Real Estate Bubble Index 2025 shows that many established global markets are facing affordability crises and bubble risks. But the Bali property market is showing signs of maturity.

Interestingly, 1- and 2-bedroom villas now account for over 62% of sales in early 2025, while off-plan projects make up around 37% of the total market.

Many owners are also adapting, with more professionally managed rentals improving operations and marketing across the island.

If you’re looking for a stable property investment, Bali remains a strong choice. We’re offering free consultations to help you invest smarter.

Click the link below to get a personalized plan tailored to your goals.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

A bubble collapse can hurt both borrower and lender confidence for years. It often exposes gaps in financial regulation and risk management, leading to strong pressure for reforms.

Investing in a bubble is highly risky. Prices may rise quickly, but so does the chance of a sharp crash. Valuations get inflated, market signals become unreliable, and speculation dominates.

Avoid bubbles by staying skeptical of hype, focusing on fundamentals, diversifying your portfolio, and working with a trusted financial advisor.

On average, annual ROI in Bali ranges from 10–15%. Rental income yields generally fall between 5–10% per year.