If there’s an art to having a low-risk and profitable property investment in Bali, it all comes down to due diligence. It’s the one step you mustn’t skip when investing or buying property in Bali.

But what is due diligence, and why is it so critical for foreigners buying property in Bali? Keep reading to understand the meaning of due diligence, the complete checklist, process, and timeline here.

Contents

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

What is Due Diligence?

Simply put, due diligence is the process of checking and verifying every important detail before you buy a property. This means ensuring:

- The property is in good condition.

- The ownership is legitimate.

- The land is zoned correctly for your intended use.

Getting everything in writing isn’t just a formality; it protects you from legal headaches, ensures your property is safe, and keeps you compliant with local laws. Most importantly, this process helps you determine whether the property you’re eyeing is truly the right fit for your investment goals or not.

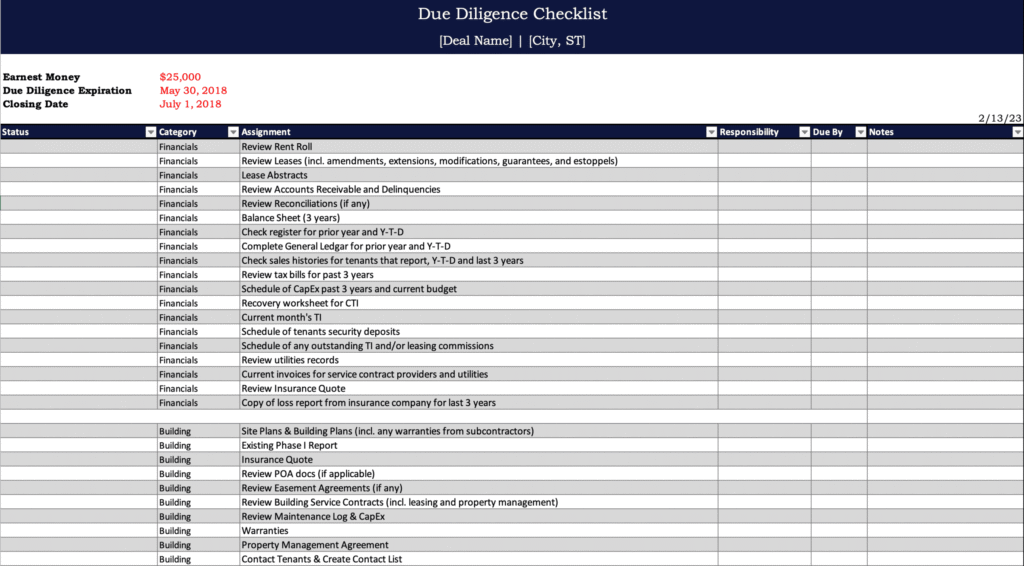

Real Estate Due Diligence Checklist

Due diligence means doing your homework and investigating every aspect of the villa or property you’re interested in. The due diligence questionnaire typically has these points:

| Checklists | Why it Matters | What to Do |

|---|---|---|

| 1. Researching the Location | The location of your villa can greatly impact its value and rental potential. | Check the area online and talk to locals, agents, or expats. Ensure it's safe, accessible, and desirable. |

| 2. Checking the Property’s History | To avoid hidden issues with the property. | Search the property's address and the seller’s background online for red flags. |

| 3. Reviewing the Property Condition | Helps avoid unexpected repair costs. | Get a condition report and review disclosures. Look for major issues. |

| 4. Environmental & Energy Reports | Environmental issues may impact your investment. | Review any available reports for hazards or inefficiencies. |

| 5. Examining Government Documents | Confirms legal compliance and avoids future problems. | Check permits, occupancy certificates, and code violations. |

| 6. Recent Repairs & Maintenance | Unresolved issues can lead to high costs later. | Review past repairs and check for ongoing or deferred maintenance. |

| 7. Obtaining a Rent Roll | Helps assess rental income and occupancy. | Ask for current rental data, lease terms, and compare to market rates. |

| 8. Reviewing Property Expenses | Helps you understand the true cost of ownership. | Analyze taxes, utilities, and other recurring costs. |

| 9. Profit & Loss Statement | Shows how well the property performs financially. | Compare income vs. expenses to assess performance. |

| 10. Evaluating Existing Debt | Important for financial planning and ROI. | Check for existing loans and compare terms with the market. |

| 11. Conducting a Site Visit | Firsthand views reveal issues not shown in reports. | Visit the villa, bring a local agent, and speak to tenants or managers. |

| 12. Planning for Future Improvements | Helps with post-purchase budgeting. | List needed repairs or upgrades after the purchase. |

| 13. Consulting Lenders | Makes the buying process smoother. | Contact local banks and explore loan options, especially for foreigners. |

| 14. Crunching the Numbers | Ensures the deal meets your investment goals. | Calculate ROI, factoring in maintenance and unexpected expenses. |

Read More: The 2 Permits Every Bali Villa Investor Needs to Stay Legal

Legal Due Diligence Process: Step-by-Step

Don’t worry, it's not you who is going to do the due diligence, but your real estate agency. If you’re working with the right team, they’ll have legal experts—like a notary—to handle everything by the book.

But it’s also beneficial to understand the due diligence process. Here’s a detailed breakdown:

1. Property Title Review

Property title review means checking all the documents and verifying the legality of:

- All relevant land/property ownership documents (e.g., land certificate, building permit)

- The authenticity and legal status of these documents with the local authorities

- A title search to check for any encumbrances, liens, or disputes on the title

- Ensuring the seller has the legal right to sell the property

You’re 75% of the way to completing when you have these pieces sorted. From there, it’s a matter of checking the property itself.

2. Property Inspection

Next is doing property inspection. Remember that this process depends on what type of property you buy. For example, if you buy an existing villa, you should check the following:

- Electrical, plumbing, roof, etc.

- Any defects, needed repairs, renovations, or potential code violations.

- The condition of interior finishes, such as flooring, walls, ceilings, and cabinetry.

- Ensure the lease agreements comply with local landlord-tenant laws and regulations.

However, for land, you should check:

- Boundaries, terrain, and potential environmental issues.

- Topography and soil analysis ( the slope and drainage patterns).

- Local zoning laws and regulations to ensure the intended use of the land is permitted.

- If there are roads available.

3. Property Occupancy Review

After knowing your property in the right ownership and zoning, it’s time to know what it can give you. For income properties, examine all existing rental/lease agreements:

- Analyze the rental rates and compare them to market rates for similar properties.

- Check the lease term (start and end dates) and any renewal options.

- Determine the current occupancy rate and vacancy levels.

If your property is brand new and has never been in the market, you can work with a local real estate agent to get ROI projections based on location, price, and expenses.

4. Review Financial Obligations

When checking rental agreements, it’s essential to understand all the money related to the property. This includes looking at:

- Any free rent periods or special deals are given to renters.

- For renters who haven’t paid their rent on time, see the rules for late payments.

- Who is responsible for paying property taxes, insurance costs, and utility bills – the owner or the renters

- Lastly, the rental contracts should explain the process if a renter doesn’t pay rent and has to be asked to leave the property. The owner may need to follow specific steps.

Looking closely at the money and payment details in the rental agreements helps ensure that there are no surprises or problems after buying the property.

5. Work with a Local Real Estate Agent

The truth is, most foreign investors cannot access the internal letters outlined in the first crucial step above. Yet, they can still invest in Bali easily and hassle-free—even without being in Bali. This is all possible because they work with a local real estate agent.

As we mentioned earlier, working with a local real estate agent can help you navigate Bali property investment with ease and minimal risk. However, be selective when choosing an agent to avoid fraud and scams.

How Long is Due Diligence Period in Real Estate?

The due diligence period in real estate usually lasts between 30 to 90 days. However, the exact duration may vary depending on the complexity of the deal and the terms agreed upon by both the buyer and seller.

Factors Affecting Due Diligence Duration

- Complexity: Larger or more complicated deals may require a longer due diligence period.

- Negotiations: The specific terms agreed upon by the buyer and seller can influence how long the period lasts.

- Contingencies: Certain conditions in the purchase agreement (like financing or inspections) can affect the due diligence period.

FAQ

1. Can you lose due diligence?

During the due diligence period, the buyer might decide not to continue with the deal. If this happens, the buyer loses the due diligence payment. This payment is only refunded if the seller decides not to go ahead with the sale.

2. Is due diligence difficult?

Due diligence can feel long and a bit scary because it involves checking many things. It’s like checking everything carefully before making a big decision.

3. What happens if you don't do due diligence?

If you skip due diligence, you might not know about problems like debts, legal issues, or rules that could stop you from buying a villa or investing in property the way you want.

Need Help for Due Diligence? Contact Us!

We understand that conducting a full investigation can be tiring and overwhelming. That’s why you can let our legal team handle your investment—from carrying out due diligence to managing property ownership permits and more.

Not only that, we also offer a free private session where we personally review your investment approach and create a plan tailored to your goals and financial situation. You can ask anything to us, from best locations, market trends, legal terms, taxes, property management, due diligence, and more.

If that is something you want, click the link below to set up a call with one of our senior advisors.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.