Key Takeaways

- Foreigners cannot own freehold land in Bali, so leasehold (Hak Sewa) is the most common and legal option.

- Main disadvantages of leasehold include extension cost uncertainty, lease depreciation, mortgage difficulty, service charges, usage restrictions, and risk at lease expiry.

- Property value decreases as the lease shortens, especially under 10–15 years remaining, making exit strategy and renewal terms critical from day one.

- Leasehold can still be profitable if structured correctly, with strong legal due diligence, clear extension clauses, proper zoning checks, and smart investment planning.

In Bali, most foreigners cannot legally own freehold land under Indonesian law (officially regulated under Law No. 5 of 1960 on Basic Agrarian Principles). Instead, they purchase villas through leasehold agreements (Hak Sewa).

This system is common, legal, and more affordable compared to freehold ownership through a PT PMA structure. However, that does not mean leasehold is risk-free.

After helping hundreds of clients purchase leasehold homes in Bali, we have seen several disadvantages tied to this type of ownership. The good news? Most of them are manageable, as long as you understand them from the beginning.

So before you commit your capital, let’s go through the disadvantages of buying a leasehold property.

1. Ground Rent Increases (or Extension Costs)

In some countries like the UK, leaseholders pay annual ground rent. In Bali, you usually pay the full lease amount upfront for 25–30 years. This means the real issue often comes later.

You can extend your lease for another 20 or 30 years, but only if the landowner agrees. And if they do, the extension price can double or even triple, especially if the area becomes highly popular (like Canggu or Uluwatu). This is one of the biggest disadvantages of buying leasehold property in fast-growing areas.

There is no guarantee that renewal costs will remain affordable. That’s why it’s crucial to clarify extension terms before signing your leasehold contract.

Read More: What Happens When Your Bali Villa Lease Expires?

2. Expensive Service Charges (If in Gated or Managed Villas)

If your leasehold villa is inside a managed complex, you may need to pay:

- Security fees

- Maintenance contributions

- Shared pool or garden costs

- Villa management commissions

If you plan to rent out your villa, these fees can reduce your rental ROI. Unlike freehold ownership, you usually have less control over how these costs are structured. This becomes very important when calculating your net yield.

3. Lease Depreciation

This is something many first-time buyers overlook. A leasehold property is a declining asset because its value follows the remaining lease period. In theory, as the lease approaches its end date, the value of the property approaches zero.

That’s why short leases are often sold at significant discounts compared to long-term leases or freehold properties.

If the remaining lease is under 10–15 years, resale value drops sharply because new buyers will need to pay high extension costs. The physical condition of the villa also affects whether the price stays stable, increases, or decreases.

That’s why leasehold always requires an exit strategy from day one.

Read More: How Long Can You Really Lease in Bali? Unlock the Facts

4. Mortgage Difficulty

Although foreigners can sometimes access financing, most Indonesian banks do not approve mortgages for leasehold (Hak Sewa) properties. Even in Western markets, banks often refuse loans for properties with short remaining lease terms. Usually, they require at least 25–30 years remaining.

So if you plan to buy a leasehold villa in Bali, you will most likely need to pay in cash. This can increase your liquidity risk.

5. Restrictions and Permissions

With leasehold, you don’t have full ownership. You own the building and the right to use the land, but not the land itself.

Depending on your contract, you may face restrictions on:

- Renovation or expansion

- Subleasing rights

- Commercial rental use

- Structural modifications

Some lease agreements in Bali require written approval from the landowner before making major changes. If not structured properly, this can affect your rental business.

6. Risk at Lease Expiry

This is what most buyers worry about. Since you are leasing, there is always a risk of losing the property at the end of the lease.

Once the lease expires — and if no extension is agreed — the land and property legally return to the landowner. Any improvements you made may also revert to the landowner, or you may be required to remove them before the lease ends.

Leasehold Compared to Freehold

Leasehold is not automatically bad. For many foreigners, it is the only legal option unless they set up a PT PMA company with higher capital requirements. Here is a quick comparison:

| Factor | Leasehold | Freehold |

|---|---|---|

| Land ownership | No | Yes |

| Asset lifespan | Limited | Permanent |

| Resale ease | Medium–Hard | Easier |

| Bank financing | Difficult | Easier |

| Long-term capital growth | Depends on lease term | Stronger |

Many investors carefully weigh the pros and cons before deciding. If your goal is to generate rental yield for 10–20 years while enjoying life in Bali, leasehold can work very well. For a deeper comparison, read our article on freehold vs leasehold ownership.

Choosing the right investment type always depends on matching your goals with the right property. If you are unsure which option is best, you can ask our senior property specialist for free guidance.

At Bali Villa Realty, we offer leasehold villas for sale for different purposes: investment, personal stay, family living, or retirement. Our specialist agents are ready to help you find the best property from scratch, based on your budget, preferred location, amenities, and more.

Contact us to book your free session, no strings attached.

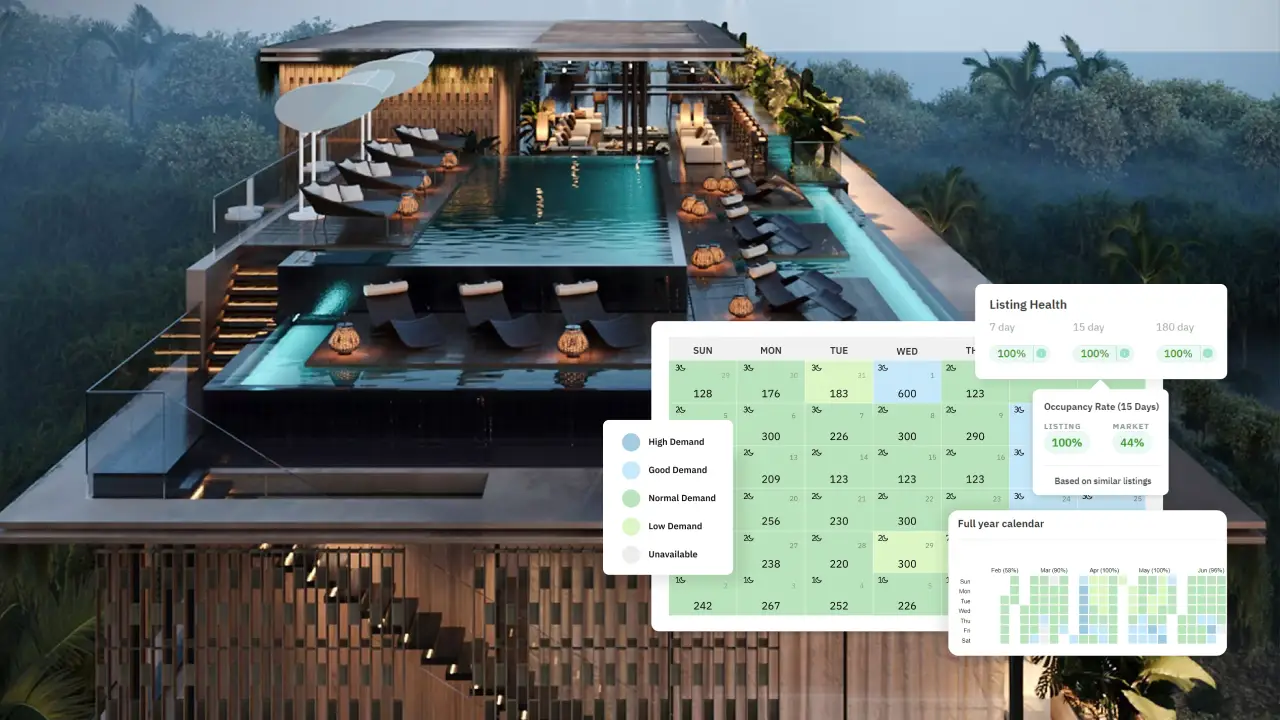

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

How to Minimize Leasehold Risks

Buying leasehold in Bali can be smart, but only if you protect yourself properly from the beginning. Here’s how to reduce leasehold risks:

1. Legal and Documentation Security

Before signing anything, make sure the legal foundation is solid:

- Use a Reputable Notary (PPAT): Never skip hiring a qualified and independent notary or legal advisor to review contracts, land certificates, and building permits (PBG/IMB). To make things easier, you can learn how to find the right notary service in Bali.

- Verify Land Ownership: Confirm the seller is the legal owner, the land is not in dispute, and it is not being used as bank collateral.

- Draft a Strong Lease Agreement: The contract should clearly outline your rights as a leaseholder — including rights to use, renovate, or sublease the property.

- Consider Using a PT PMA: For foreign investors, setting up a PT PMA (foreign-owned company) to lease property can provide stronger legal structure compared to holding it personally.

2. Managing Lease Duration and Renewal

Leasehold value depends heavily on time. The shorter the remaining lease, the lower the property value. So, planning ahead is key:

- Secure a Long Lease: Ideally, invest in properties with at least 25–30 years remaining to protect your ROI.

- Negotiate Extension Terms Early: Define renewal duration, pricing structure, and notice periods clearly in the initial agreement to avoid inflated renewal costs later.

- Fix the Extension Price: Try to secure an extension price upfront or agree that it will be based on an independent market appraisal.

3. Avoiding Financial and Operational Risks

Beyond paperwork, you also need to ensure the property itself is legally and financially safe:

- Verify Bali Land Zoning: Make sure the land is zoned for residential or tourism use to avoid demolition risks or legal trouble.

- Inspect the Property Condition: Hire a professional inspector to check for structural or hidden defects, especially for off-plan or older villas.

- Confirm Tax Responsibilities: Ensure all land and building taxes (PBB) are paid and clearly state in the contract who is responsible for future tax payments.

4. Mitigating Depreciation

Leasehold properties naturally decrease in value as the end date approaches. But with smart planning, you can manage this:

- Plan Your Exit Strategy Early: Once the remaining lease drops below 10–15 years, resale value declines quickly. Either extend the lease or sell before reaching that stage.

- Choose High-Demand Locations: Investing in areas like Seminyak, Canggu, or other strong tourist markets helps maintain rental income and offset lease depreciation.

Read More: 10 Best Areas to Invest in Bali Real Estate 2026 For Foreigners

Conclusion

Those are the main disadvantages foreigners may face when buying a leasehold villa in Bali.

Leasehold is the safest, most legal, and easiest way for foreigners to own property in Bali. However, it is temporary (25–30 years) and does not provide full land ownership.

Still, you can generate strong returns by planning your strategy properly, reviewing the contract carefully (especially extension clauses), and negotiating well with the landowner.

If you need help investing safely in Bali, our senior specialists at Bali Villa Realty are ready to assist anytime. Book your free consultation session here.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

It can be, especially if the remaining lease is under 20 years. Buyers heavily discount short leases. Always consider resale timing before buying.

Not necessarily. It becomes risky if:

- The contract is poorly drafted

- There is no clear extension clause

- You overpay in a speculative area

You receive the right to use the property for a fixed number of years. After it expires, rights return to the landowner unless extended. You do not permanently own the land.