Disclaimer: This article is for informational purposes only, and is not intended to replace consultation with professional advisors. We strongly recommend speaking with a qualified senior property advisor before making any final investment decisions.

Key Takeaways

- Apartment buildings are a strong alternative to invest in Bali, especially for foreign investors seeking lower entry prices and stable long-term income.

- Compared to villas, apartments generally require less upfront capital, offer easier diversification, and come with simpler management.

- Apartments mainly target long-term renters such as expats, digital nomads, corporate staff, and retirees, resulting in more stable year-round occupancy.

- For foreigners, investing in Bali apartment requires the right legal structure such as leasehold, Hak Pakai, or a PT PMA setup.

- A low purchase price alone does not guarantee a good investment; rental demand, location, and competing supply are more important than property price.

Villas are popular with foreign investors, but they’re not the only option to invest in Bali. Apartment buildings are a serious alternative asset, especially for people seeking lower entry prices, simpler management and stable long-term income.

This asset remains highly attractive in the market because its development strongly focuses on lifestyle renters. Today, many apartments are designed to resemble resorts and are equipped with wellness facilities, which significantly increases their appeal and value.

In this guide, we will explain how to invest in apartment buildings in Bali, in simple and practical terms. We will also answer common questions like:

- Is buying an apartment complex a good investment?

- How do apartments make money?

- How to invest in apartment buildings for beginners?

So if you’re looking for opportunities beyond villas, keep reading to learn more and understand what to expect.

Why Invest in Apartments in Bali?

Apartments in Bali are still an emerging asset class. That is exactly why many investors are paying attention.Here are the main reasons foreigners consider apartments:

1. Lower Entry Price Than Villas

Compared to villas, apartments usually:

- Require less capital upfront

- Have smaller land exposure

- Offer easier diversification (own 2 units instead of 1 villa)

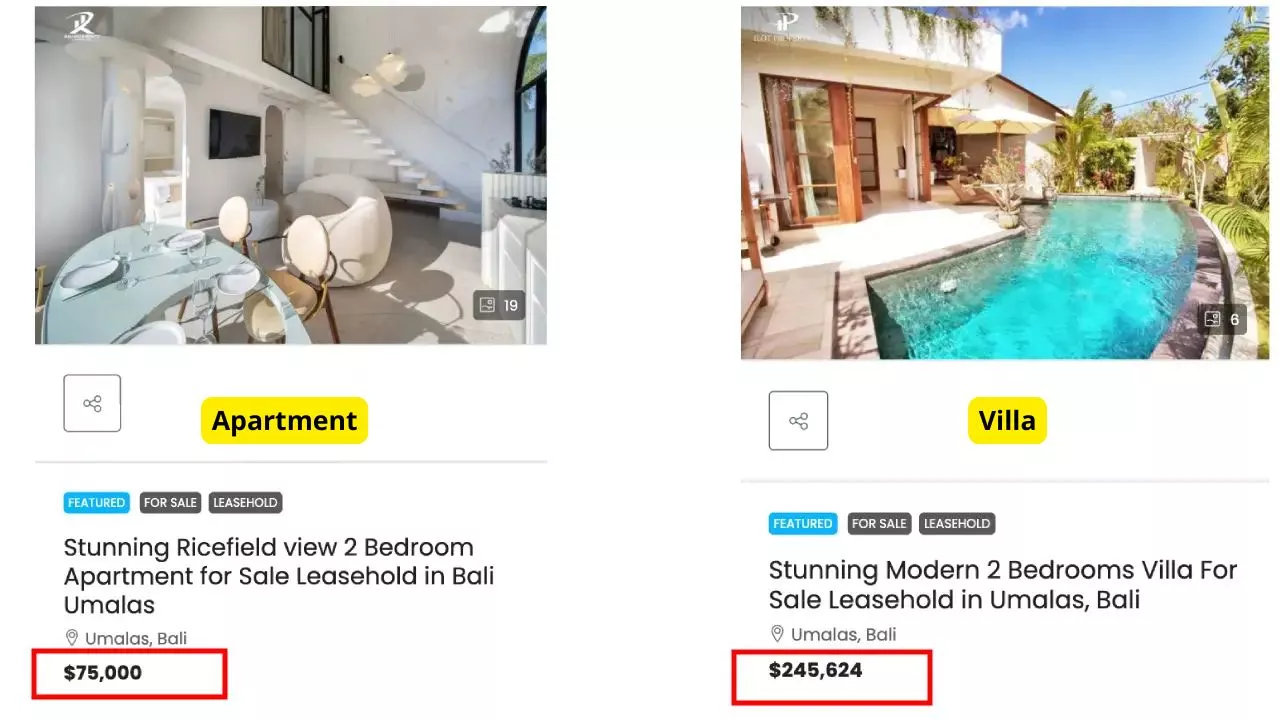

In many areas, apartment units start far below villa prices, making them attractive for first-time investors. For example, from our database, the lowest price difference between a 2-bedroom apartment and a villa in Umalas is about $170,000 (IDR 2,85B)

You could buy an apartment for $75,000 (≈ Rp 1,26B), whereas for a villa you might need up to $245,000 (≈ Rp 4,11B)

2. Strong Demand From Long-Term Renters

Apartments serve a different market than holiday villas. They target long renters, such as:

- Expats working in Bali

- Digital nomads staying 6–12 months

- Corporate staff and consultants

- Retirees who want convenience

This creates more stable, year-round occupancy, especially in areas like Canggu, Berawa, Umalas, and Sanur.

3. Easier Management

Apartments inside an apartment complex often include centralized security, shared maintenance, and building management teams. This reduces the hands-on burden compared to standalone villas.

How to Invest in Apartment Buildings in Bali

1. Choose the Right Apartment Type

Apartments in Bali generally fall into several categories:

- Small apartment complexes (1-bedroom units)

This is one of the most common apartment types in Bali. These 1-bedroom units are usually designed within a single complex under one legal setup. Entry costs are higher compared to individual units, but they offer more control over operations and stronger long-term value. - Strata-title apartment units

These are single units within a larger building, similar to condominiums in many other countries. You own the individual unit while sharing common facilities such as parking, elevators, and security. This option is popular for long-term rentals and for resale to other investors or end users. - Serviced apartments

These units are professionally managed and often come with hotel-style services such as reception, housekeeping, and maintenance. Rental income tends to be more stable, but management fees are usually higher and owners have less operational control.

Each apartment type comes with different regulations, management structures, and income potential.

For example, small 1-bedroom complexes and strata-title units give you more direct control over the property and day-to-day decisions. Serviced apartments, on the other hand, are handled entirely by a professional management team.

From an income perspective, serviced apartments often allow higher rental rates, but the target market can be more limited. In contrast, small 1-bedroom units and individual apartment units usually attract a wider pool of renters because rental prices are more affordable and flexible.

Browse Bali Apartments for Sale in Top Areas

2. Understand Legal Ownership for Foreigners

Foreigners cannot directly hold freehold (Hak Milik) property in Bali. This is one of the most important things to understand before buying any apartment.

Common legal routes include:

- Leasehold (Hak Sewa): You lease the property for a fixed period (usually 25–30 years), with options to extend. This is common for individual apartment units and lower entry investments.

- Hak Pakai (Right to Use): A legal right granted to foreigners under certain conditions, often used for residential purposes. It is more regulated but offers stronger protection than informal lease agreements.

- PT PMA structure (foreign-owned company): This structure is often used when buying multiple units or an apartment complex. It allows the company to hold HGB (Right to Build), which is closer to ownership for business purposes.

3. Analyze Rental Demand, Not Just Price

A cheap apartment is not always a good investment. Instead of focusing only on price, look at who will rent the unit and why.

The simplest way to learn about key buyer profile is to pay close attention to:

- Proximity to work hubs, cafes, beaches, and international schools

- Long-term rental demand from expats, digital nomads, and corporate tenants

- Competing apartment supply within the same area and price range

For example, areas with strong co-working scenes and lifestyle infrastructure tend to attract long-stay renters, which reduces vacancy risk.

Market reports show that long-term rentals in prime Bali areas remain more stable than short-term holiday stays, especially during tourism downturns. You can read the full breakdown here: Navigating Seasonal Patterns in Bali Tourism to Still Get the Best Profits

4. Run Real Numbers

Before committing, always calculate real investment performance. Key numbers to review include:

- Net rental yield, after management fees, agent fees, and taxes

- Annual maintenance costs and sinking fund contributions

- Remaining lease duration vs price paid, which directly affects exit value

Read More: Bali Villa Rental Yield 2026: Here’s How Much You Can Expect

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Key Considerations Before Investing in an Apartment

1. Location

Where an apartment is located has a major impact on its investment value. When visiting a property, consider how close it is to essential places such as offices, schools, hospitals, shopping areas, and public transportation. A strategic location not only makes daily life easier but also supports stronger long-term resale potential.

2. Budget

Setting a realistic budget is a crucial step. Beyond the purchase price, factor in recurring costs such as maintenance fees, property taxes, and insurance. Make sure the total financial commitment fits comfortably within your income so you can manage payments without unnecessary pressure.

Read More: Cost of Property in Bali 2026: What You Need to Know

3. Amenities

Take time to evaluate the facilities offered within the apartment complex. Amenities such as parking, gyms, swimming pools, heated swimming pools, security systems, green spaces, and shared recreational areas can significantly improve both comfort and rental appeal.

The key is ensuring these features truly match your lifestyle or tenant expectations, rather than paying for extras you won’t use.

4. Property Condition and Layout

Carefully inspect the condition of the unit and the overall building. Watch for signs of structural issues, water leaks, or general deterioration that could lead to costly repairs later.

Don't forget to check the layout. A well-designed floor plan should feel practical, efficient, and comfortable for everyday living.

5. Neighbourhood

The surrounding area matters just as much as the apartment itself. Consider safety, cleanliness, noise levels, and the overall environment. Research the neighbourhood’s reputation and planned developments, as these factors can influence both quality of life and future property value.

In addition, look into future development plans around the area. New roads, commercial centers, or zoning changes can significantly affect property values and livability. Staying informed about planned projects helps you anticipate both opportunities and potential drawbacks before investing.

6. Legal Compliance

Ensure the property meets all legal requirements before proceeding. This includes verifying ownership documents, land-use permits, and building approvals.

It’s strongly recommended to work with legal professionals to confirm there are no disputes or unresolved legal issues that could affect your ownership rights. At Bali Villa Realty, we have an in-house legal team that can handle the full due diligence process for you.

You can start by booking a free consultation with our senior advisor here.

Conclusion

An apartment can be a solid investment in Bali, especially if you’re looking for steady long-term income with less day-to-day management. We hope this guide on how to invest in apartment buildings in Bali has given you clearer insight before taking your next step.

If you’d like to explore your options or have a more in-depth discussion, feel free to talk to us anytime. Our senior property advisors are happy to help you navigate Bali property investments smoothly, from planning to purchase.

With the right strategy and professional guidance, apartments can be a practical and rewarding investment path in Bali.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

Yes. Apartments can be a reliable investment, especially for investors focused on rental income in well-developed areas. They usually require a lower initial budget compared to villas and can offer more predictable cash flow.

Apartments typically earn income through long-term or monthly rentals. Over time, value appreciation and income from shared facilities or services can also contribute to overall returns.

Yes, it is possible. However, foreigners cannot directly own land in Indonesia. Ownership is structured through specific legal arrangements, which determine how the apartment can be held and used. For more details, you can check our guidelines here.

For foreign investors, investing without capital is very unlikely. Regulations generally require a significant upfront payment—often between 10% and 30%—along with proof of sufficient funds.

From an investment point of view, apartments come with ongoing maintenance fees and may have slower resale growth compared to landed properties.

For occupants, apartments usually offer less space and privacy, and are subject to building rules that can limit pets, visitors, renovations, or additional occupants.