Bali offers exceptional investment opportunities for property. A study shows that Bali’s economy is set to grow between 5.0% and 5.8% in 2025, which is faster than Indonesia’s national forecast. That makes now a great time to invest in Bali.

As a foreigner, you have plenty of options: real estate (villas, apartments, land), hospitality (hotels and resorts), or business ventures (cafés, restaurants, boutique shops). But if we’re being honest, real estate is the best choice.

Why? Let’s look at why you should invest in Bali and the best strategies to do it legally and profitably.

Contents

Key Takeaways

- Bali’s economy is expected to grow between 5.0% and 5.8% in 2025, with tourism and local demand keeping occupancy rates high, rental yields strong (8–20%), and ROI coming in as fast as 5–6 years.

- Foreigners can invest legally through Leasehold (Hak Sewa), Right to Build (HGB via PT PMA), or Right to Use (Hak Pakai).

- The best areas to invest include prime hotspots like Canggu, Berawa, Seminyak, Kuta, Kedungu, Cemagi, and Pererenan.

- To succeed, you’ll have to research the market, pick the right villa type, verify ownership, manage your property well, and have an exit plan for the best returns.

Explore Bali's Luxury Real Estate: Bali Villas for Sale - Leasehold and Freehold

Why Should You Invest in Bali?

Bali stands out as a prime villa investment location due to its high returns. From our experience, we’ve seen our clients achieve ROI from 7% to 18% annually, and in some cases, up to 20%.

Here’s a closer look at why you should consider putting your money here:

1. Bali’s Economic Situation (2025)

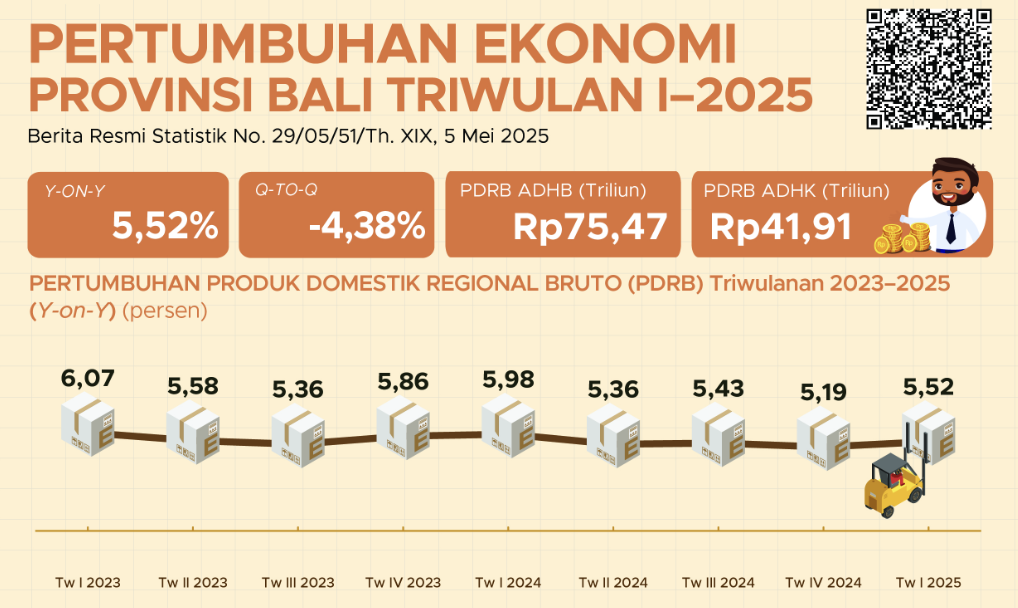

Overall, Bali’s economy grew by 5.52% in the first quarter of 2025 compared to the same period last year, according to a report from BPS Indonesia.

Bali tourism also saw an increase, with 591,221 foreign tourists visiting the island in April 2025. This is a 25.56% rise compared to March (470,851 visitors).

2. High Occupancy Rates

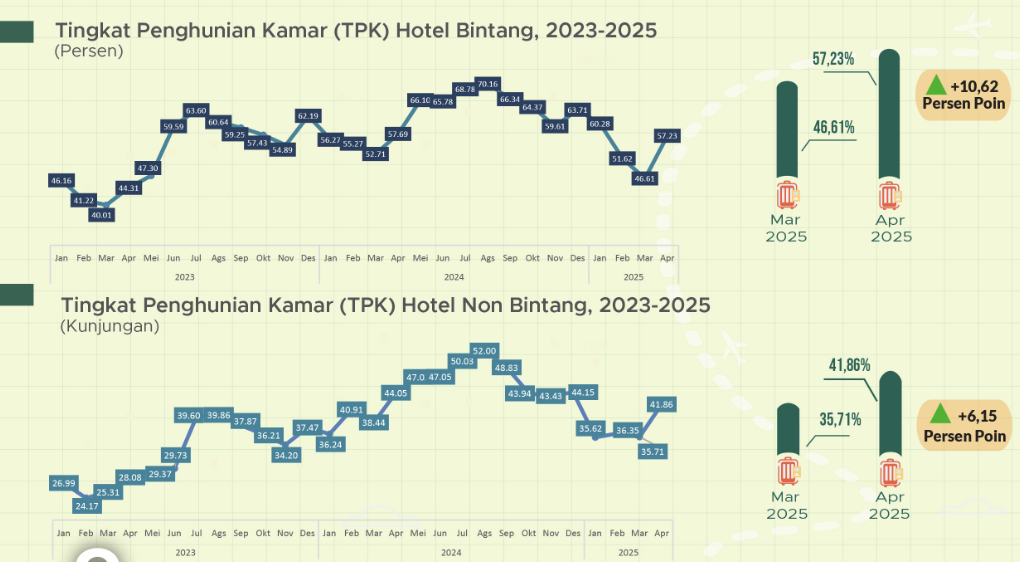

The current Bali Occupancy Rate (the number of people staying in hotels) reached 57.23%. This shows an increase of 10.62% compared to March 2025 (46.61%).

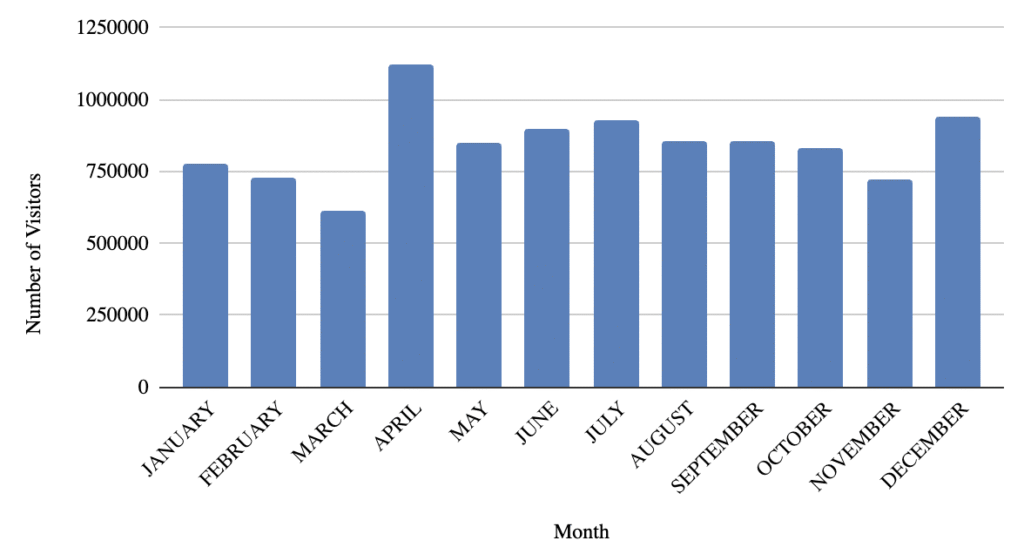

Bali also continues to attract many visitors. According to the 2024 report, at least 6.3 million people arrived through Ngurah Rai Airport.

This data demonstrates that Bali’s conditions remain very favorable for property and tourism businesses, making it a promising prospect for investment.

3. High Demand from Domestic Markets

It's not just international tourists flocking to Bali—the island is also a favorite holiday spot for domestic visitors.You can see the number of domestic visitors to Bali in 2024 from Satu Data Indonesia - Bali here:

It's worth noting that most locals travel with extended family—such as nannies, grandparents, kids, and parents—and they stay for either short or long-term holidays.

This creates a consistent demand for larger rental properties year-round.

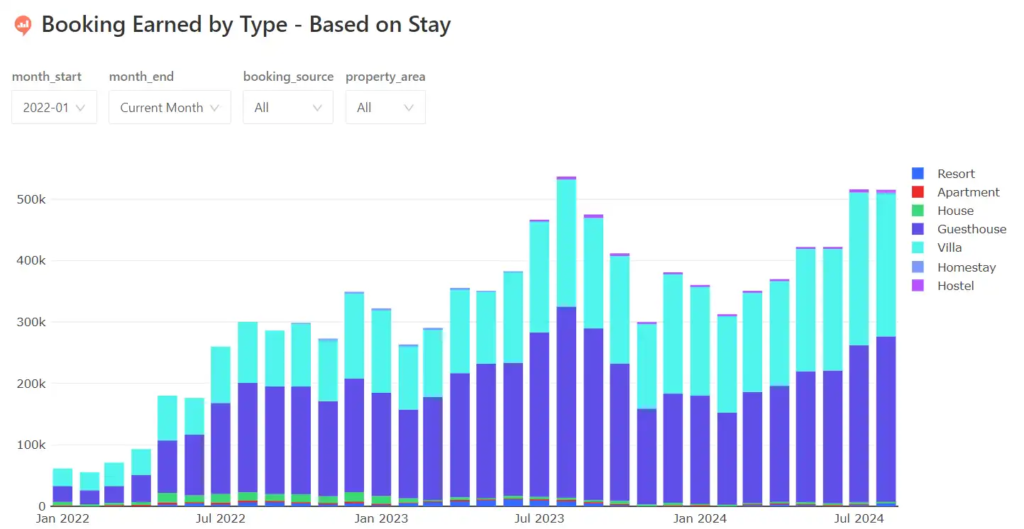

These groups also often prefer the space and comfort of a villa over a hotel, as shown in the data below:

4. Affordable Investment Entry Points

Compared to other real estate hotspots in Asia, like Singapore or Hong Kong, Bali offers a much more accessible entry point.

Here, you can buy an apartment for as low as $85,000 or lease land starting at $200,000.

Bali also has been identified as one of the cities with the lowest home prices globally, yet it offers high-quality services and amenities, lively markets, and beautiful scenery.

This affordability opens the door for a wider range of investors to get into the market.

5. High Returns On Investment (ROI)

Bali's property market is known for its impressive returns. Investors can see annual rental yields between 8-12%, with some premium properties in high-demand areas, like Seminyak or Canggu, reaching up to 20%.

What's more, properties can often pay for themselves in as little as 5-6 years due to the strong rental income and potential for appreciation.

You can explore more real case studies regarding Bali ROI in our guide here:

Get Your Free Bali Villa ROI Report

Learn real case study data and insights to help you maximize your investment returns in Bali.

How to Invest in Bali Real Estate Safely and Legally

Ready to get started? Here’s how you can safely buy villa in Bali for investment:

1. Start with Research and Planning

Bali is full of different places, each with its own vibe and opportunities. Knowing what you’re after will help narrow down your search.

Some spots are great if you’re looking for peace (like Ubud or Uluwatu), while others are always buzzing with visitors (like Seminyak or Canggu).

As you start looking at different villas, pay attention to their location and what they offer (unique selling points), like swimming pools, beach or rice field views, spacious rooms, or nearby hotspots.

These features will help you attract more visitors easily and get the most out of your villa investment.

Read More: 10 Best Areas to Invest in Bali Real Estate 2025

2. Decide on the Development Stage

When buying your villa, you’ve got a couple of choices:

| Villa Type | Pros | Cons |

|---|---|---|

| Off-plan villa | - Usually cheaper - Could increase in value once completed - Flexible design options | - Construction delays due to weather or material availability may affect the timeline |

| Already-built villa | - You see exactly what you’re buying, making it easier to assess value - Can start earning rental income immediately | - No flexibility in design - May require renovations or updates to match your preferences |

3. Find the Right Villa in Bali

Looking for the perfect property for your Bali investment? There are two important things to check in this step:

- Explore the Property Listing: Start by exploring a variety of websites to see what’s available. It’s also advised to chat with trusted local real estate agents, friends, and acquaintances to discuss the best deals or suggestions.

- Estimating Villa Cost: The price of villas in Bali varies depending on several factors, like the size, proximity to important spots, and the details of the lease agreement.

Learn more about pricing factors, taxes, and ways to estimate your property investment here: Cost of Property in Bali: What You Need to Know (2025)

4. Conduct a Site Inspection

Whether you’re choosing land, a villa, or an apartment, it’s vital to personally visit the property to inspect its condition, location, and surroundings—because sometimes what’s in the picture is not the same in reality.

If you can’t visit Bali or want to invest remotely, we recommend having your trusted notary or intermediaries inspect the property and report everything to you.

5. Verify the Seller and Do Your Due Diligence

Keep in mind that properties in Bali often have multiple owners due to inheritance, so ensuring the rightful ownership is vital.

You should verify the seller’s legitimacy and conduct thorough due diligence before finalizing your property purchase.

Steps to Take:

- Check Ownership: Ensure the property’s title and history are clear. A trusted notary can help you verify the original ownership documents, like the Hak Milik Certificate, and match the seller’s ID documents with the property details.

- Review Legal Documents: Work with a reliable notary to confirm that all paperwork, such as land titles and tax payments, is in order. This prevents hidden issues that could cause problems later.

6. Arrange Your Finances

Once you're ready to buy, use a notary's escrow account to hold your funds securely until the entire transaction is complete.

This ensures your funds are safe until all legal checks are completed and the property transfer is secure.

Here’s another tip: avoid sending money directly to the seller to protect your investment. There’s no guarantee that everything will go as planned, and you might face complications if something goes wrong.

7. Manage Your Property

If you're not planning to stay in Bali all year or want to manage your investment from afar, it's a good idea to find a reliable property management company.

They will handle everything, such as:

- Promoting your rental to get more daily or monthly renters

- Managing bookings

- Ensuring your business aligns with local laws and regulations

- Handling day-to-day tasks, such as cleaning, paying monthly fees, and maintaining the property

- Making sure your guests have a great stay

If you want to know more about managing your property overseas, read our special post: The Ultimate Guide to Property Management in Bali.

Bali Property Ownership Rules for Foreigners

Can foreigner buy property in Bali? Yes, foreigners can own freehold property in Indonesia, but not directly in their name.

However, there are secure and legal alternative ways to invest:

- Leasehold (Hak Sewa): This is the most popular choice for foreign investors. You lease a property for a set period, typically 25–30 years, with options to extend.

- Right to Build (Hak Guna Bangunan – HGB): This title allows you to build on leased land and is often used by foreign-owned companies (PT PMA). Setting up a PT PMA requires an investment of about 10 billion Indonesian Rupiah (around USD $700,000).

- Right to Use (Hak Pakai): This title allows foreigners to use a property for a specific period, often for residential purposes.

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Where is The Best Place to Invest in Bali?

If you’re looking to invest in Bali, knowing the different areas is key to making the right choice:

| Area Type | Description | Perfect For | Examples |

|---|---|---|---|

| Prime Hotspots | The most popular areas where prices are already high, close to main attractions, and crowded | Investors looking for trendy, high-demand areas with great rental income potential and fast profits | Canggu, Berawa, Umalas |

| Built-up Areas | Well-established areas with high prices that may limit profit growth due to fierce competition | First-time investors or those avoiding big risks | Batu Belig, Seminyak, Kuta |

| Up-and-Coming Areas | Rapidly developing areas with reasonable property prices | Long-term investors seeking significant return potential as these areas grow | Kedungu, Nyanyi, Cemagi, Seseh |

| Emerging Areas | Less-developed regions starting to gain attention. They offer good value now with the potential for significant appreciation as they develop further. | Long-term investors seeking significant return potential as these areas grow | Pererenan |

Not only that, you also need to learn about Bali’s land zoning. Land zoning is a set of rules that govern what you can build and do on a piece of land.

These rules help keep things organized and ensure that buildings and activities fit well with the area.

Strategies to Maximize Your Villa ROI

If you want your Bali property investment to be profitable, it all comes down to having the right strategy. Here are some key tips to keep in mind:

- Stay informed about market trends: Keep an eye on the latest Bali property market updates. Check credible sources like real estate newsletters, Bali news portals, market analyst social media or influencers, online forums, and niche media such as Indonesia Expat.

- Evaluate the rental potential: Research the rental market in your chosen area to understand demand. Talking to an experienced property agent can also help you estimate potential rental income.

- Avoid common mistakes: Learn from other expats or trusted real estate consultants. They can help you spot red flags, avoid scams, and share tips to protect your investment.

- Plan your exit strategy: Set clear investment goals and prepare different scenarios for when you decide to sell or exit. This plan will help keep you safe if the market takes an unexpected turn.

Conclusion: Ready to Invest in Bali?

Bali offers amazing returns (ROI up to 18%), but the process can be tricky. That’s why reading an investment guide PDF isn’t always enough. You may have questions or specific issues that need clear answers.

For this reason, working with the right agent from the beginning is essential. At Bali Villa Realty, we make buying, managing, and profiting from your villa simple.

Whether you’re new to investing or already own multiple properties, we’ve got you covered.

What you'll get:

- Smooth transactions

- Hassle-free management

- Free personalized investment plan

If that’s what you’re looking for, click the link to book your free, no-obligation consultation today. Schedule anytime that’s convenient for you.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

1. Is buying property in Bali a good investment?

Yes. Smaller villas in Bali can generate rental yields of 8–10%, along with steady value growth. Hotspots like Canggu and Uluwatu often see occupancy rates of around 85%, making them strong choices for profitable property investment.

2. Which areas in Bali are best for investment?

- Canggu: Known for strong rental demand and a lively social scene.

- Uluwatu: Great for beachfront and surf-focused properties.

- Ubud: Best for wellness-focused and cultural getaway investments.

- North Bali: Lower entry prices with big potential for future growth.

3. How much do I need to invest in Bali?

You can start investing in Bali’s property market with around $100,000 USD.

4. What is the return on real estate in Bali?

Properties in major tourist destinations typically generate a gross yield of 8% to 15%, while net yields (after expenses) often range between 10% and 12%.