Indonesia frequently updates its customs regulations—and one recent change sparked public concern.

While it aimed to protect local industries, the new import restriction raised concerns about its impact on migrant workers and international travelers, who could face duties on personal items. Many also feared the rules might lead to abuse or unofficial fees at the airport.

If you're a foreign visitor, it's important to stay informed. We’ve summarized the latest changes to Indonesia’s customs policy, including what you can and can’t bring into the country. Read this article before you book your flight.

Key Takeaways

- The March 2024 import rule has been revoked.

- Travelers no longer need to follow the 2023 restricted items list.

- Migrant workers can bring goods worth up to $1,500/year duty-free.

- New rules may still come, but the government promises a people-first approach.

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Recent Import Regulations Issued to Tighten Trade Controls

The Indonesia’s Ministry of Trade has rolled out two major import regulations:

- Regulation No. 36 of 2023 (December 2023). This regulation came into effect on 10 March 2024, replacing the earlier regulations (No. 20/2021 and No. 25/2022).

- Update through Regulation No. 3 of 2024 (March 2024), which amended several import rules.

Here are the key changes introduced in Regulation No 3 of 2024:

- Updated Import Rules for Specific Goods: Now includes new requirements for importing plastic raw materials, chemicals, aircraft spare parts, and horticultural products.

- Revised Import Permit Procedures: The process for obtaining import permits has been adjusted, with added steps and updated requirements for approval.

- New Categories of Restricted Goods: The regulation introduces more product classifications that are now subject to import limitations.

- Expanded List of Used Goods Allowed for Import: Certain used items that were previously restricted can now be imported legally under the updated rules.

- Tighter Controls on Passenger-Carried Goods: Stricter checks and limits now apply to goods brought into the country by air travelers.

These changes aim to strengthen the monitoring of imports and protect local markets by limiting the entry of certain goods.

Read More: New Regulations Are Changing How You Buy Property in Bali

Challenges Raised by the New Import Regulations

However, the change has drawn public criticism. The regulation is feared to have broad impacts and pose various challenges for businesses, such as:

- Getting Permission Takes Longer: The new rules make it harder to get permission to import things like steel, clothes, and used items.

- Unclear Rules About How Much You Can Import: Businesses need government data to get import permission, but if it's not ready, their request can be delayed or rejected.

- Limits on What Travelers Can Bring: People coming into Indonesia can only bring a few things with them. For example, only 5 electronic items worth up to $1,500 per person per year.

- New Codes for Goods Must Be Checked: Each item has a code (called HS Code), and if businesses don’t check the updates, their goods could be blocked or sent back.

- It Might Cost More and Slow Down Business: Because of more rules and steps, importing can cost more money and time. This can hurt profits and make it harder for local businesses to compete.

Read More: Can Foreigners Own Property in Bali?

What Travelers Can Bring Now to Indonesia

In response to public pressure, the Trade Minister officially revoked the regulation that came into effect in March 2024.

The decision was made to avoid causing unnecessary burden on individuals, especially travelers and migrant workers.

This means migrant workers from Indonesia can once again bring in parcels worth up to $1,500 per year without paying duties.

For more details, check the table below to see what you can and can’t bring into Indonesia:

| Category | What You Can Bring | What You Can’t Bring |

|---|---|---|

| Personal Items | Clothes, bags, toiletries, jewelry (for personal use, under USD 250); must declare if more | – |

| Cash | Up to IDR 100 million (or equivalent); must declare if more | – |

| Alcohol | Up to 1 liter per person | More than 1 litre without declaring |

| Tobacco | Max: 200 cigarettes, 50 cigars, or 100g tobacco | Over these limits |

| Electronics | Max 2 items (e.g. phones, laptops, tablets); no need to declare for short visits under 3 months | More than 2 items, or undeclared electronics |

| Medicine | Allowed with a doctor’s prescription | Chinese traditional medicine is not allowed |

| Drugs | – | All illegal drugs (narcotics, cannabis, etc.) – strictly forbidden |

| Weapons | – | Guns, firearms, ammo, explosives – strictly forbidden |

| Pornography | – | Pornographic materials – strictly forbidden |

| Other Items | – | Fake goods, cordless phones, plants, animals, cultural artefacts (restricted) |

What’s Next: Future Indonesia Import Regulations

Although the current rule has been scrapped, the Finance Ministry still plans to introduce new regulations to limit certain imported goods—mainly to protect local industries.

However, the government has stated it will take a more careful and balanced approach to ensure future policies won’t negatively affect individuals.

The goal is to defend local businesses while still being fair to travelers and overseas workers.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

1. How much is import tax in Indonesia?

All imported goods usually have to pay 11% VAT, which is Indonesia’s normal tax rate.

2. Can we bring food into Indonesia?

Yes. It’s okay to bring small amounts of food for yourself.

3. When to fill out Indonesia customs declaration form?

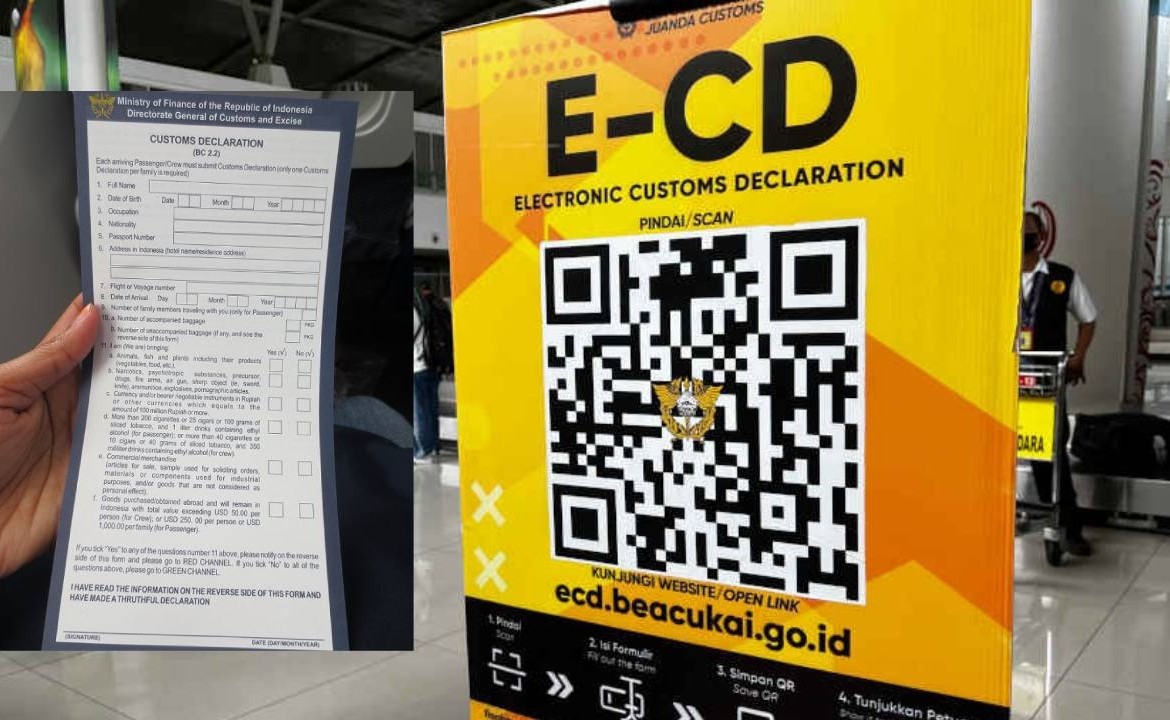

You must fill out the customs form online within 72 hours before your flight. After that, you’ll get a QR code—save it on your phone or print it out.

4. What happens if you don't fill out a customs form?

If you don’t follow the rules, customs in Indonesia might reject, return, or even destroy your package.