When visiting Bali, travelers have endless choices for where to stay. But villas and hotels remain the top picks.

As an investor, it’s essential to understand what today’s guests really want today, and which option gives you the best returns.

Do they prefer the privacy and comfort of a villa, or the luxury and convenience of a hotel?

In this guide, we’ll explore what travelers are choosing today and which investment offers smarter opportunities in Bali’s real estate market.

Key Takeaways

- Traveler preferences are shifting toward villas, driven by demand for privacy, space, and longer stays—resulting in villas often outperforming hotels in occupancy and ROI(e.g., villa occupancy of 75% vs. hotels’ 53–60% in 2024).

- Hotels still dominate short-term stays, offering strong brand trust, full amenities, better cost efficiency, and lower investment risk.

- A potential Airbnb ban in 2026 may push more travelers toward hotels, creating a strategic opportunity for investors to diversify into both villas (long-term stays) and hotels (short-term stays).

- A mixed investment approach delivers more stability, maximizing income streams and reducing dependency on any single platform or traveler segment.

Bali Travel & Real Estate Market 2025: What the Numbers Show

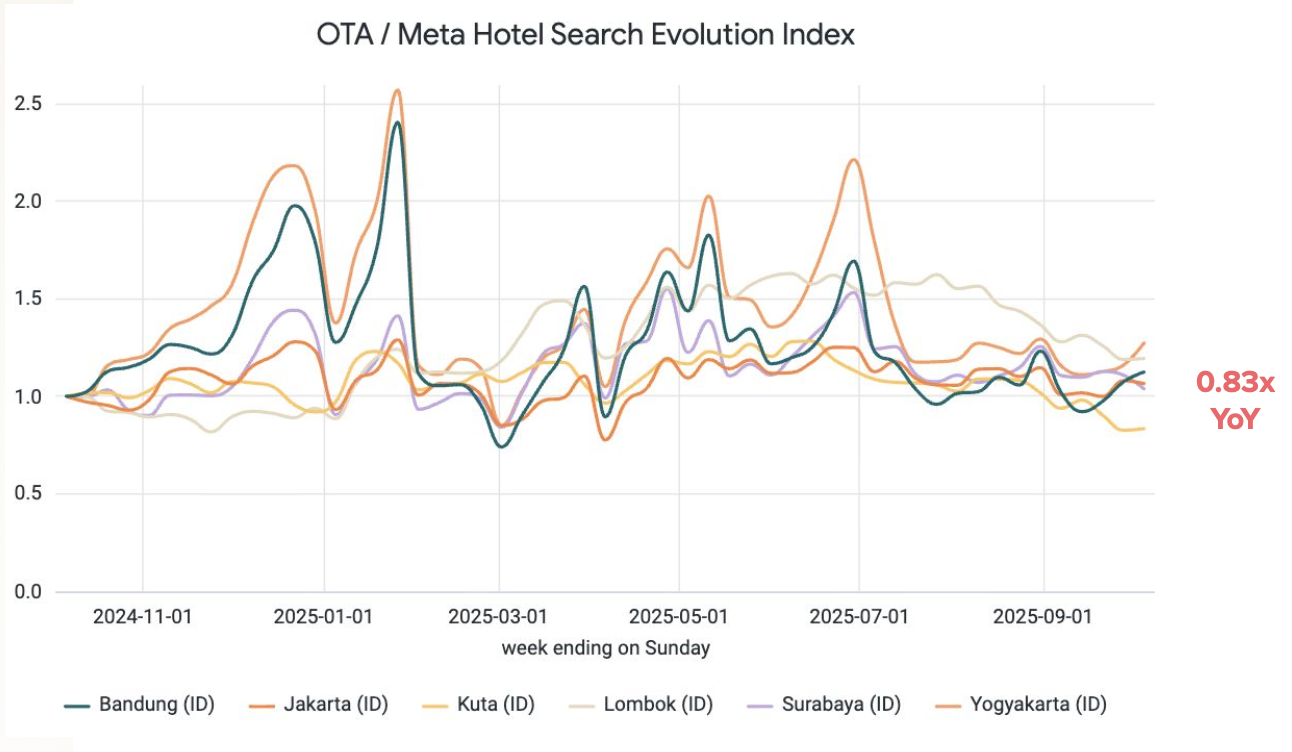

According to the Bali Market Update – October 2025 report by Lighthouse, overall travel interest to Bali remains strong but shows a slight cooling trend compared to last year:

- Flight Search Index: 0.90× year-on-year (YoY)

- Hotel Search Index: 0.83× YoY

This indicates that while Bali continues to attract global travelers, fewer people are actively searching for hotel stays than before.

It's a sign that traveler preferences are slowly shifting toward alternative accommodations like villas and private rentals.

Villas are quickly catching up to—and in many cases, surpassing—hotel performance.

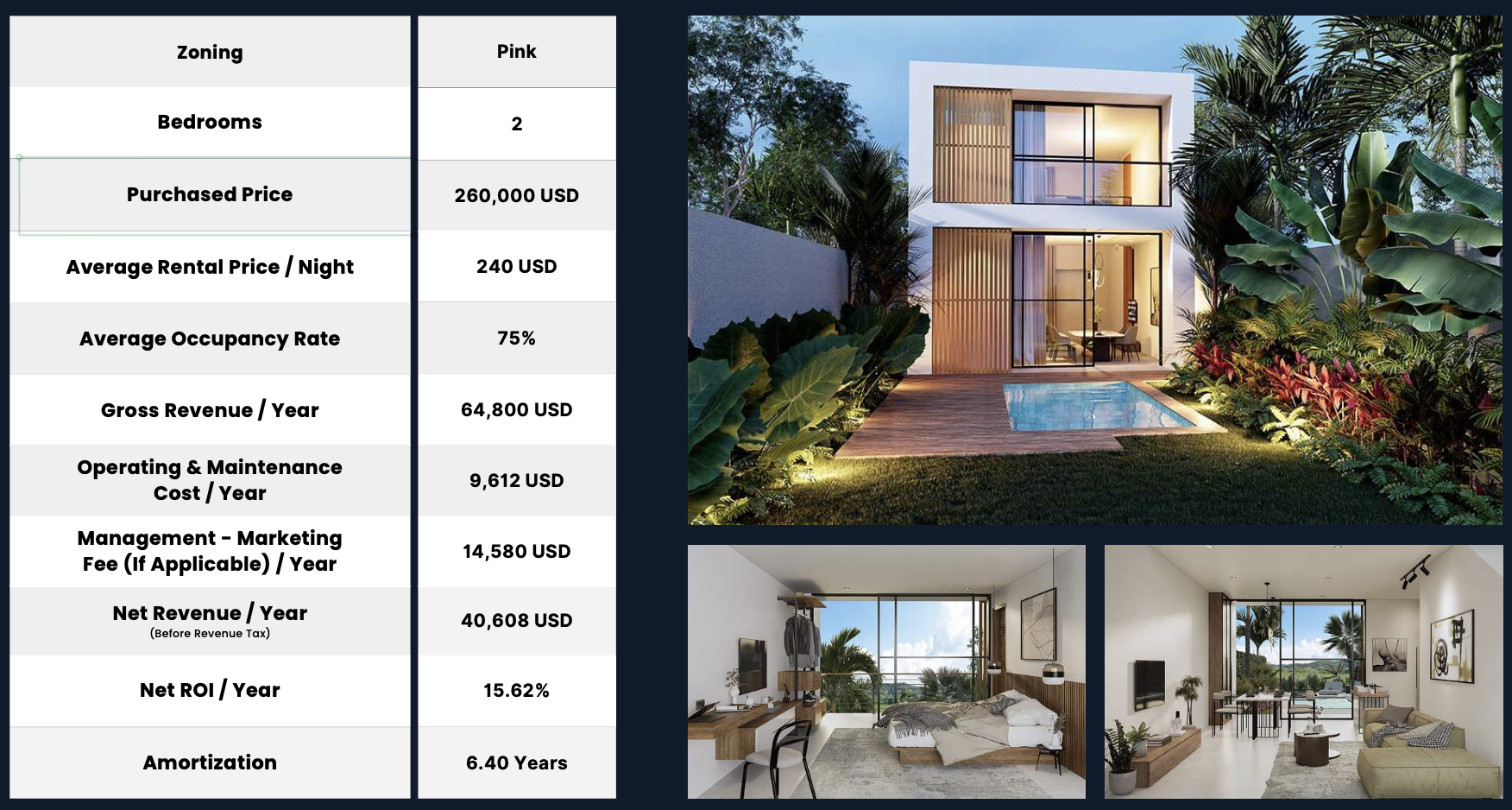

For example, one of Bali Villa Realty’s villa investments in Uluwatu (shown in the image below) achieved an average occupancy rate of 75% in 2024 with a net ROI of 15.62%. In comparison, Bali hotels’ average occupancy in 2024 reached 53–60%.

In terms of regional demand, Canggu and Ubud continue to stand out as Bali’s most searched areas for longer stays and lifestyle travel, while Kuta and the Southern Peninsula (including Nusa Dua and Jimbaran) are seeing softer hotel demand.

This aligns with the growing trend of digital nomads, long-term travelers, and families seeking space, privacy, and flexibility—features that villas naturally offer.

At the same time, traditional hotels remain attractive for short-stay guests and luxury travelers, offering convenience, brand reliability, and full-service amenities.

Read More: How to Buy Property in Bali from Abroad: Complete Guide

Get Your Free Bali Villa ROI Report

Learn real case study data and insights to help you maximize your investment returns in Bali.

What Modern Renters Are Looking For: The Big Change in Bali Travel Habits

Traveler behavior and key buyers in Bali is changing.

While hotels have long been the go-to option for tourists, recent trends show that many visitors now seek more personal and flexible accommodation.

This shift is influencing how investors view villa and hotel opportunities in Bali’s 2026 real estate market.

Why Renters Are Choosing Villas

Modern travelers—especially digital nomads, long-stay visitors, and small families—are increasingly drawn to private villas. They offer:

- Privacy and space: No crowded pools or shared facilities; just a private sanctuary.

- Home-like comfort: Full kitchens, living rooms, and work-friendly setups that feel like “home in Bali.”

- Group value: Cost-efficient for families or groups who can share a larger space.

- Lifestyle appeal: Villas in areas like Canggu and Ubud fit the slow-living, wellness, and work-from-anywhere lifestyle that defines Bali today.

Many renters now look for longer stays rather than weekend getaways, making villas not just a leisure choice, but a lifestyle choice.

How Hotels Still Perform Well

Even so, hotels continue to lead the game when it comes to short-term stays and overall convenience. Here are some key advantages of investing in hotels:

- Better Cost Management: Hotels run far more efficiently than standalone villas, which helps them keep costs down and maintain stronger occupancy.

- Professional Management: With experienced hotel operators handling everything, investors don’t need to worry about day-to-day tasks—and performance stays consistent.

- Stronger Market Reach: Branded hotels, especially luxury 4- and 5-star ones, draw in more guests thanks to wider visibility and established trust.

- Better Guest Experience: Hotels offer complete services—F&B outlets, events, resort facilities—making guests happier and more likely to return.

- Lower Investment Risk: Returns come from the entire hotel operation, not just one unit, which makes the investment more stable and predictable.

New Strategy to Diversify Your Bali Property Investment

Hotel demand is expected to surge starting in 2026, following the growing discussions about a potential Airbnb ban by the Bali government.

Right now, most villas rely heavily on Airbnb for short-term rental income. So, if Airbnb is restricted or blocked, hotels may quickly become the main accommodation choice for travelers—potentially creating a sharp increase in demand and occupancy as a side effect.

This shift could be highly advantageous for hotel investors.

That’s why now is the perfect moment to diversify your property investment portfolio. Here’s a simple yet effective approach:

- Rent out your villa for long-term stays, and promote it through your own marketing channels (website, Instagram, WhatsApp, trusted agents).

- Use hotels for short-term income, allowing you to enjoy stable returns regardless of market changes or regulatory shifts.

With this combination, you’re not only protecting your assets from the risks of relying on a single platform, you’re also maximizing profit potential across two different market segments.

Learn how to diversify your real estate portfolio and achieve maximum growth here: Bali Investment Property Portfolio Growth Hacks (Proven Tips).

Conclusion

Both villas and hotels remain strong investment options in Bali’s 2025–2026 market. But what investors should keep in mind is that now is the ideal time to diversify your real estate portfolio—especially with the possibility of an Airbnb ban in 2026, which could push short-stay demand toward hotels.

So it’s smarter to spread your investments, for example by using hotels for short-term rentals and your villa for long-term stays. You can also hire professional property management to handle the day-to-day work easier.

Want to start investment with your own personalized plan? We're here to help you anytime.

At Bali Villa Realty by Ilot Property, We handle every aspect of your villa investment, from planning, ROI calculation and professional maintenance. So, you can enjoy a truly hands-off investment experience.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

Foreigners can’t own freehold land directly, but can invest through long-term leasehold agreements or a PT PMA company structure, which is fully legal in Indonesia.

Most villas are sold on 25–30-year leases, often extendable up to 80-99 years with proper renewal clauses.

Yes. Bali offers lower entry costs than many other resort destinations, strong tourism demand, and a mature rental infrastructure — ideal for newcomers when guided by a reliable local agency.

Growth in eco-friendly design, digital-nomad-ready homes, and branded villa resorts that blend hotel services with villa privacy.