Key Takeaways

- 2026 is still a good time to invest in Bali property, but the market is more mature and strategic than before.

- Investing early in the right locations can lock in better value before prices adjust upward. That's why now is the best time to invest.

- 2026 is not “easy money”: competition is higher, and success requires strong location choice, realistic returns, and professional guidance.

- Key risks include oversaturated areas, weak fundamentals, overestimated rental yields, and poor ownership structures. These risks are manageable with proper due diligence and work with trusted real estate team.

As we enter 2026, many investors are wondering whether this is the right time to invest. Should you start buying a villa now, or wait until another year? That’s exactly what we’re going to explain in this article.

In real estate, timing matters just as much as location. Entering too early can expose you to unnecessary risk. Waiting too long can be just as costly—you might miss the strongest phase of growth altogether.

When we wrote our report on the Bali market outlook for 2026, we found that Bali’s real estate market is no longer a speculative playground.

It is maturing into a serious, globally recognised investment destination. And for the right buyer, this moment presents a compelling balance of opportunity, clarity, and long-term potential.

Let’s take a closer look.

When is the Right Time to Invest in Bali?

Honestly, now is the best time to enter the Bali property market.

Property prices in Bali are still moving upward, especially in emerging areas that are expected to become the next big focus in 2026.

These aren’t guesses. This shift is closely tied to real infrastructure plans, including new road networks and the proposed North Bali airport, which are opening up areas that were previously overlooked.

At the same time, buyer demand is changing. Investors today aren’t just chasing fast flips. Many are looking for eco-friendly and wellness-focused properties—villas designed for long stays, retreats, and lifestyle travel.

This isn’t just a Bali trend either. Globally, wellness tourism is growing faster than traditional travel, which naturally pulls more international buyers toward destinations like Bali.

And here’s the part many people don’t like to hear: waiting usually doesn’t make things cheaper. As these areas develop and demand spreads, prices tend to adjust upward, not the other way around.

Investing earlier lets you lock in better value, choose stronger locations, and benefit from both capital growth and consistent rental income as the market matures.

So no, this isn’t about rushing in blindly. It’s about understanding where the market is heading and positioning yourself before the crowd arrives.

Explore Bali Villa For Sale - New Listing 2026

How to Know When It's a Good Time to Invest?

Knowing when to invest in Bali isn’t about guessing the market peak. It’s about reading the right signals:

Tourism Performance

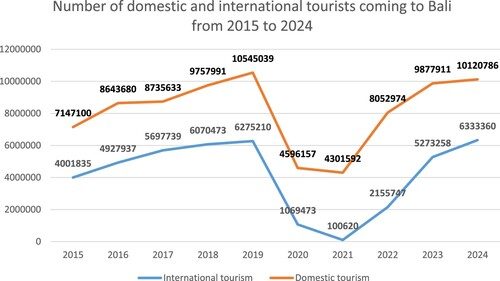

Tourism is still the backbone of Bali’s rental market. A steady rise in international arrivals usually means stronger demand for villas, resorts, and long-stay accommodation.

Bali’s recovery has been especially strong. International visitor numbers have already surpassed pre-pandemic levels, which is a major confidence signal for hospitality-driven property investments.

Occupancy Rates

High occupancy isn’t just about peak season anymore. What investors should really look at is how properties perform during shoulder and low seasons.

In many well-positioned areas, occupancy rates remain stable year-round, driven by long-stay travelers, digital nomads, and wellness-focused visitors.

That consistency is what supports reliable monthly cash flow, not just seasonal spikes. This is why it’s important to understand Bali’s high and low seasons, so you can adjust your investment strategy accordingly.

Property Value Appreciation

Rather than chasing hype, smart investors track areas with steady price growth over multiple years.

Consistent appreciation usually means the market is supported by real demand, infrastructure, and livability.

Many emerging areas are still early in this curve, which is where long-term upside tends to be strongest.

Read More: Bali vs. Hawaii: Which Is Better for Holidays and Investment?

Government Support & Infrastructure Development

Infrastructure matters more than marketing. New road networks, proposed airport developments, and regional connectivity projects often trigger value growth in nearby locations.

At the same time, Indonesia continues to refine regulations to make foreign investment clearer and more structured, which improves long-term investor confidence.

Economic Stability & Currency Factors

A stable economy, manageable inflation, and a relatively predictable currency environment all reduce uncertainty for foreign investors.

While currency fluctuations can affect short-term returns, long-term investors often benefit when asset values and rental income grow faster than currency movement.

Invest in Bali Real Estate 2026: Not "Too Late", But Also Not "Easy"

We've seen so many questions about investing in Bali property in 2026. Is 2026 really a good year to buy villa in Bali?

We'd say that it's not too late for you, but it's also not going to be easy.

Investing in 2026 still profitable because the long-stay demand continue to grow stronger, along with the rise of emerging spots in Bali.

In addition, the current hotspot is also not going to slow down. So investor can target both short and long term rentals business.

Another reason 2026 stands out is ownership accessibility. Setting up a business through PT PMA is now easier than ever, allowing foreigner to run a business and own a property in Bali legally.

However, 2026 is also not gonna be 100% easy because there's already quiet a lot of villas and foreign business running on the island.

With such a strong competition, villa owners need to think creative to make their property stand out and attract renters. they also need to learn about their customers needs so they can give the right service.

Again, 2026 is believed to be the year of mature market. so expect a slower but steadier capital appreciation rather than just a short viral hype.

Read More: Bali Travel Trend 2026: New Tour Routes & Fresh Experiences

Risks of Investing in Bali Property in 2026

No matter the year or market condition, there are always risks involved in property investing. Some of the main risks investors may face include:

- Entering too early in locations without strong fundamentals

- Entering too late in oversaturated areas

- Overestimating potential rental returns

- Poorly structured ownership setups or unclear exit strategies

- Liquidity constraints and external factors such as tourism fluctuations or regulatory changes

The good news is that these risks are manageable with proper due diligence, realistic expectations, and professional guidance.

At Bali Villa Realty, we help investors navigate these challenges by providing clear market insights, verified listings, and structured investment advice.

Every investor’s situation is different, that’s why we offer complimentary consultations to help you understand:

- Which areas align best with your investment goals

- What ownership structures are most suitable for you

- When to enter the market based on your strategy and risk profile

- How to avoid common pitfalls and identify quality opportunities

Book a free, no-strings-attached consultation here to get personalized guidance for your Bali property investment.

Get a Customized Investment Plan in Bali

With over 15+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Conclusion

To sum it up, now is a good time to invest in Bali property.

That said, the best opportunities in Bali are rarely one-size-fits-all. Success in Bali property comes down to choosing the right location, the right product, the right timing, and the right guidance.

Whether you’re actively looking to invest or simply exploring your options, our team is here to provide clear, honest, and local insight.

Book a free consultation with Bali Villa Realty and take the next step with confidence.

Want to start investing in Bali property?

Have a quick chat with our real estate experts for personalized advice on your Bali investments. No commitment required.

FAQ

No. With professional legal, sales, and management support, most investors can complete the process remotely. Visiting is helpful but not required.

Bali property is best suited for a 5–10 year investment horizon, allowing time for appreciation and rental optimization.

Building offers more control but higher risk. Completed or turnkey properties provide faster income and lower complexity.

Rather than focusing on the lowest price, investors should prioritize location, quality, and management to support long-term performance.